US Factory Orders Plunged In April

요약:After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - U

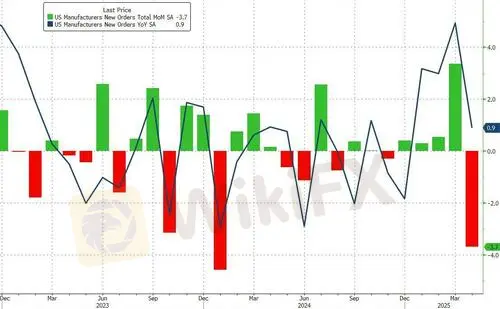

After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - US Factory Orders tumbled 3.7% in April (worse than the 3.2% MoM decline expected). Also, the 4.3% rise in March was revised down to a 3.4% MoM rise...

Source: Bloomberg

The MoM drop was the biggest since Jan 2024as tariff-frontrunning faded, dragging the headline orders down to just +0.9% YoY.

Core Factory Orders (excluding the more volatile Transportation sector) fell for the second straight month, down 0.5% MoM

Source: Bloomberg

That weakness dragged core factory orders down 0.08% YoY.

Is the 'hard' data and 'soft' data about to start converging?

Or is this 'transitory'?

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기