US Factory Orders Plunged In April

Abstract:After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - U

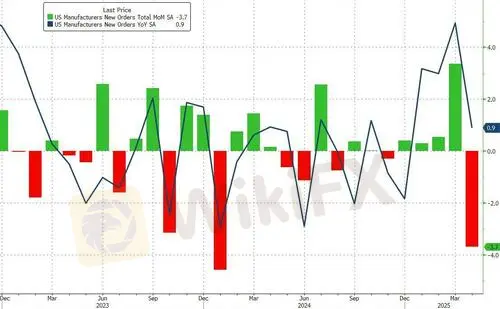

After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - US Factory Orders tumbled 3.7% in April (worse than the 3.2% MoM decline expected). Also, the 4.3% rise in March was revised down to a 3.4% MoM rise...

Source: Bloomberg

The MoM drop was the biggest since Jan 2024as tariff-frontrunning faded, dragging the headline orders down to just +0.9% YoY.

Core Factory Orders (excluding the more volatile Transportation sector) fell for the second straight month, down 0.5% MoM

Source: Bloomberg

That weakness dragged core factory orders down 0.08% YoY.

Is the 'hard' data and 'soft' data about to start converging?

Or is this 'transitory'?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Trader in Thane Duped of ₹4.11 Cr in Online Scam

BlackBull Markets and CopyTrade Market Formalise Integration

IG Japan Ends Discount Program on Aug 17

Plus500 Launches $90 Million Share Buyback Programme

Strongest Level for MYR Coming Soon?!

Modi gives tax boon to India's economy amid Trump tariff tensions

Bybit Exposed: Traders Hit Hard by Withdrawal Denials, Account Bans & More

Fraud Alert: FCA Warns Against 10 Unlicensed Brokers

Currency Calculator