US Factory Orders Plunged In April

Ikhtisar:After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - U

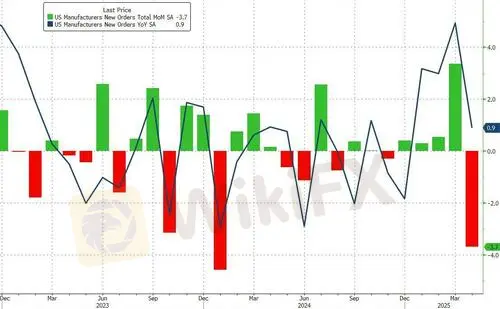

After surging in March - tariff-frontrunning dominated with the largest MoM rise since July 2020 - US Factory Orders tumbled 3.7% in April (worse than the 3.2% MoM decline expected). Also, the 4.3% rise in March was revised down to a 3.4% MoM rise...

Source: Bloomberg

The MoM drop was the biggest since Jan 2024as tariff-frontrunning faded, dragging the headline orders down to just +0.9% YoY.

Core Factory Orders (excluding the more volatile Transportation sector) fell for the second straight month, down 0.5% MoM

Source: Bloomberg

That weakness dragged core factory orders down 0.08% YoY.

Is the 'hard' data and 'soft' data about to start converging?

Or is this 'transitory'?

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

WikiFX Broker

Berita Terhangat

"Malam Elite Ho Chi Minh" Sukses Digelar, Soroti Pembangunan Ekosistem Forex Berkelanjutan

Nilai Tukar