How Tariffs Might Impact US Car Prices, By Brand

Extrait:Tariffs on imported goods can have a wide ripple effect on prices, especially in the auto industry w

Tariffs on imported goods can have a wide ripple effect on prices, especially in the auto industry where supply chains are global, complex, and highly sensitive to cost changes.

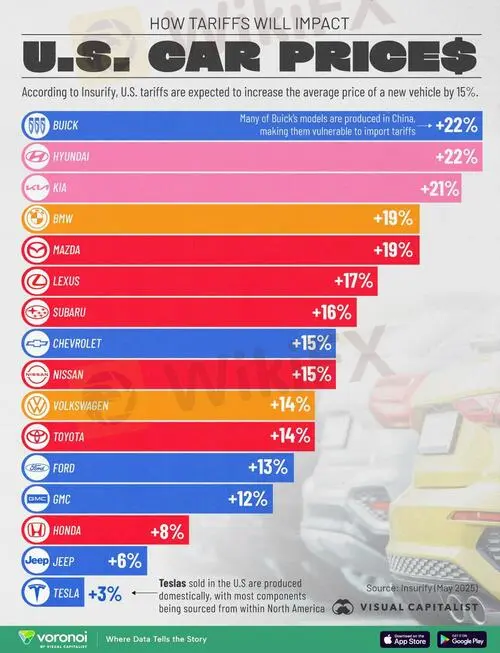

In this graphic, Visual Capitalist's Marcus Lu reveals how tariffs will impact U.S. car prices, assuming a flat 25% tariff is applied onto vehicles imported from outside North America.

Data & Discussion

The data for this visualization comes from Insurify, which projected price increases for various car brands based on their exposure to overseas manufacturing and parts.

For models assembled within North America, the projections represent a 25% tariff on a models non-U.S. content and up to a 15% tariff discount of the total MSRP. Visit the official White House fact sheet to learn more.

The analysis shows that Tesla, Jeep, and Hondawill be the least affected by Trumps auto tariffs, while Buick, Hyundai, and Kiawill face the steepest price hikes.

Buicks Asia-Centric Production

Although Buickis an American brand, the company produces many of its models in China and South Korea. As a result, Buick tops this list with a 22%projected price increase—the highest among all brands surveyed.

This underscores how globalization has changed the footprint of even legacy U.S. nameplates. In fact, Buick is so big in China it has its own sub-brand.

Hyundai and Kia Face High Tariff Risks

Other vulnerable brands are Hyundaiand Kia, each projected to see a 21–22%increase in vehicle prices. Though both brands have some manufacturing presence in the U.S., a significant portion of their models and components are still imported from South Korea.

In late 2024, Hyundai Motor Group Metaplant Americaopened in Georgia, which the company will use to build its U.S.-sold electric vehicles. The plant is capable of producing up to 500,000 vehicles per year.

Tesla Is the Least Affected

Tesla‘s vertically integrated supply chain and domestic manufacturing help shield it from tariff risks. With most of its production based in the U.S.—particularly at its Fremont and Austin plants—Tesla’s vehicles are projected to increase in price by only 3% under new tariff rules.

This minimal impact could give Tesla a competitive edge if other brands are forced to raise prices. Fortune recently reported that Tesla is still Americas EV leader, though sales dropped year-over-year in April by 16%.

Avertissement:

Les opinions exprimées dans cet article représentent le point de vue personnel de l'auteur et ne constituent pas des conseils d'investissement de la plateforme. La plateforme ne garantit pas l'exactitude, l'exhaustivité ou l'actualité des informations contenues dans cet article et n'est pas responsable de toute perte résultant de l'utilisation ou de la confiance dans les informations contenues dans cet article.

Courtiers WikiFX

Interactive Brokers

FBS

Saxo Banque

ATFX

FXTM

OANDA

Interactive Brokers

FBS

Saxo Banque

ATFX

FXTM

OANDA

Courtiers WikiFX

Interactive Brokers

FBS

Saxo Banque

ATFX

FXTM

OANDA

Interactive Brokers

FBS

Saxo Banque

ATFX

FXTM

OANDA

Calcul du taux de change