简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

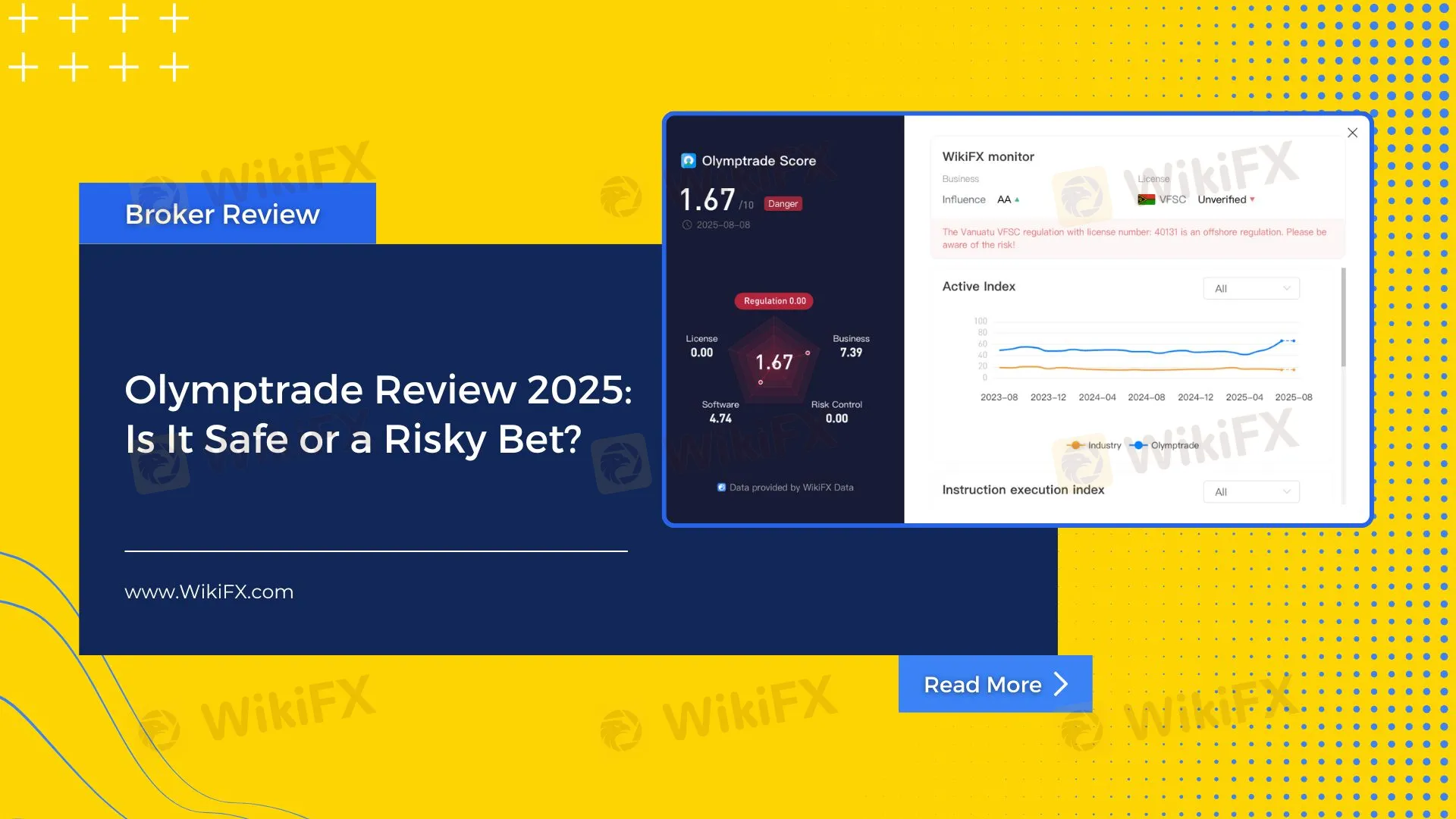

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Abstract:Olymptrade review based on WikiFX data: operates without valid regulation, offers web and mobile trading, but faces multiple user complaints.

Broker Profile

According to its WikiFX page, Olymptrade operates under the company Aollikus Limited, registered in Vanuatu. The official website is olymptrade.com, with customer support reachable via support@olymptrade.com or +356 2034 16 34. The company address is listed as 1276, Govant Building, Kumul Highway, Port Vila, Vanuatu.

Regulatory Information

The broker profile displays a Vanuatu Financial Services Commission (VFSC) Retail Forex License, License No. 40131, issued to Aollikus Limited. However, the license status is marked Unverified, and WikiFX prominently states that the broker currently has no valid regulation. This means it should be treated as unregulated, carrying higher potential risk for traders.

Trading Platform & Services

The platform type is listed as self-developed, indicating that Olymptrade does not use common third-party solutions such as MT4 or MT5. The broker is tagged as engaging in global business and carrying a high potential risk label. The page does not list detailed account types or a full range of tradable instruments; traders would need to check the brokers own website for product specifics.

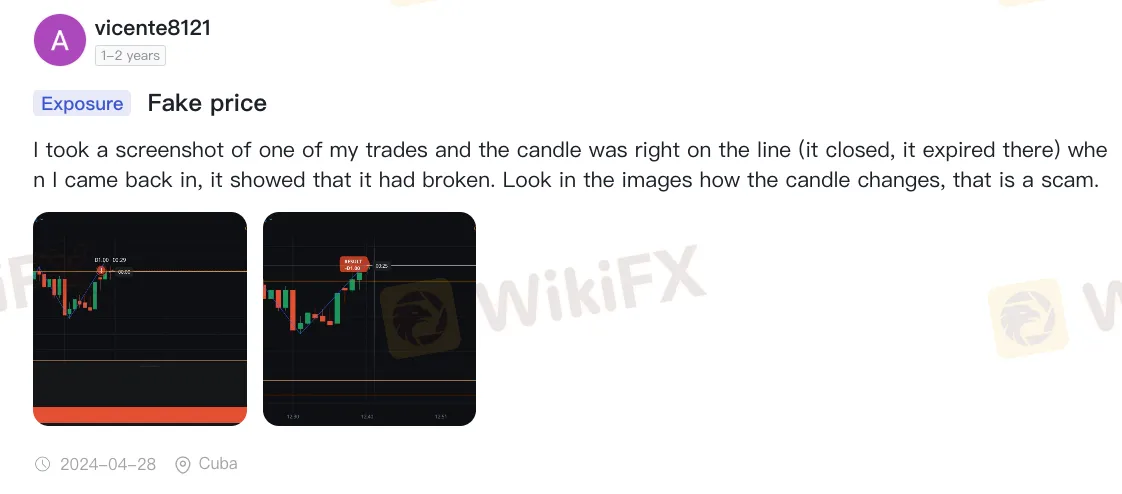

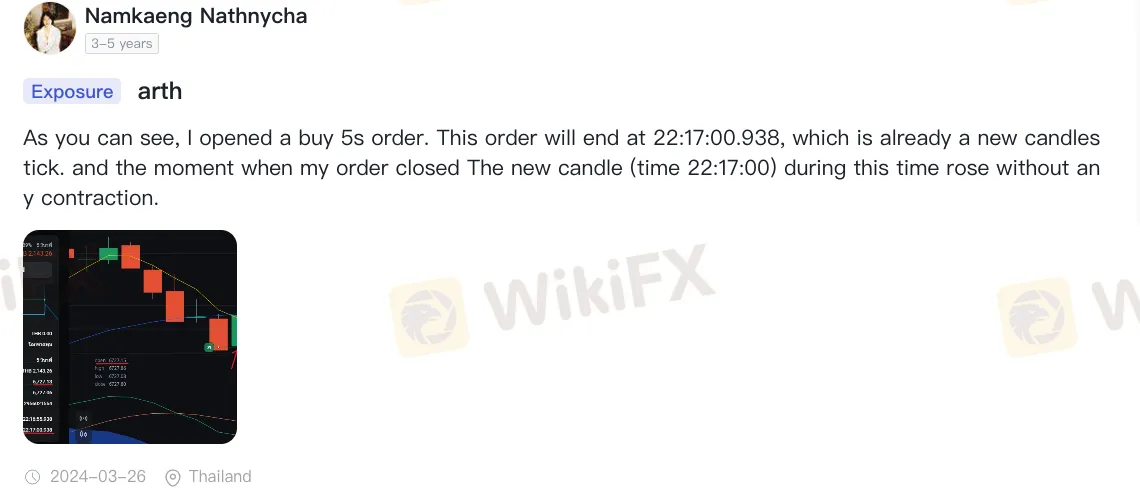

User Exposure Records

The WikiFX profile contains multiple exposure posts from users over recent years. Reported issues include withdrawal delays, execution and pricing disputes, and account restrictions. Notable entries appear across 2024, 2023, and earlier, showing an ongoing pattern of complaints.

Risk Considerations

- No valid regulation: License entry is Unverified.

- High-risk label on WikiFX profile.

- Multiple user complaints documented on the brokers page.

Conclusion

Based on the WikiFX profile, Olymptrade is displayed as unregulated under the VFSC license entry for Aollikus Limited. With a self-developed platform, a high-risk label, and a history of user complaints, traders are advised to exercise caution. Before engaging, review the brokers profile and exposure records in detail.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FCA Prosecutes £1.3m Facebook Ponzi Targeting Retail

FCA prosecutes £1.3m Facebook-based Ponzi scheme targeting retail investors, highlighting rising social media investment fraud and regulator enforcement.

OANDA Japan Mandates 2FA for Enhanced Trading Platform Security

OANDA Japan will implement mandatory 2FA using Google Authenticator in 2025 to boost trading platform security, protecting against phishing and SIM swap attacks.

Charles Schwab Forex Review 2025: What Traders Should Know

An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

The Global Inflation Outlook

Olymptrade Review 2025: Is It Safe or a Risky Bet?

The Debt And Deficit Problem Isn't What You Think

OANDA Japan Mandates 2FA for Enhanced Trading Platform Security

FCA Prosecutes £1.3m Facebook Ponzi Targeting Retail

Currency Calculator