简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into Exclusive Markets

Resumo:In the fast-growing world of online trading, security and regulation are essential. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

In the fast-growing world of online trading, security and regulation are essential. For retail investors, the choice of a broker can determine not just potential profits but the safety of their capital. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

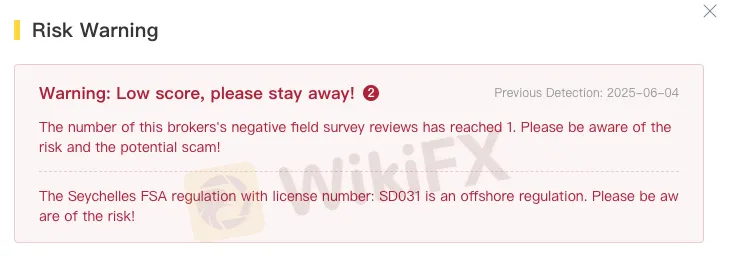

Exclusive Markets Ltd is licensed by the Seychelles Financial Services Authority (FSA), holding a retail forex licence under the registration number SD031. While this may seem reassuring at first glance, it is crucial to understand the nature of the FSA itself. As an offshore regulator, the FSA does not enforce the same stringent compliance and investor protection standards as more established authorities in Europe or North America. This makes licences issued by such offshore jurisdictions inherently weaker from an investor protection standpoint.

Further concerns were raised when WikiFX, a well-known third-party platform that monitors the regulatory status and credibility of global brokers, conducted a field investigation into Exclusive Markets. WikiFX, which aggregates licensing information from over 40 financial regulators worldwide and monitors user complaints, dispatched a team to visit the broker's listed regulatory address in Seychelles. However, the team could not locate the company at that address, leading to serious doubts about whether the broker maintains any physical presence in the country at all. (Read the full article here: https://www.wikifx.com/en/survey/948783db5b.html)

The inability to verify a physical office presence raises immediate concerns about transparency and accountability. According to WikiFXs findings, Exclusive Markets did not appear to operate from the location it has publicly registered, suggesting it may not be maintaining a legitimate local office. This absence makes it more difficult for regulatory authorities or affected investors to hold the company accountable should disputes or irregularities arise.

WikiFX assigns brokers a trust score based on a variety of factors, including regulation, corporate transparency, and user feedback. While Exclusive Markets is technically regulated, the combination of its offshore licence and the lack of a verifiable office undermines its trustworthiness in the eyes of many.

Investors are urged to exercise caution and conduct thorough due diligence before engaging with brokers, especially those licensed offshore or operating in jurisdictions with limited oversight. WikiFX‘s recommendation is clear: traders should make informed decisions based on a complete assessment of a broker’s regulatory status, operational transparency, and physical presence.

In an industry where unregulated or loosely regulated entities could cause significant financial harm, these red flags should not be taken lightly. Traders must remain vigilant, question what lies behind a broker's glossy website, and seek solid proof of legitimacy before making any commitments.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

IC Markets Global

FXCM

STARTRADER

Exness

FOREX.com

Saxo

IC Markets Global

FXCM

STARTRADER

Exness

FOREX.com

Saxo

Corretora WikiFX

IC Markets Global

FXCM

STARTRADER

Exness

FOREX.com

Saxo

IC Markets Global

FXCM

STARTRADER

Exness

FOREX.com

Saxo

Últimas notícias

Guia SkyLine 2025 Malásia: 100 Juízes de Renome Reunidos com Sucesso

Ouro Dispara: Dados Econômicos Fracos dos EUA e Tensões Comerciais Crescentes

Taiwan Registra Novo Recorde em Reservas Forex em Maio de 2025

FXGlobe: Brasileiro Perde US$ 1.000 em Golpe do Bônus de 100%

ATFX Expande Presença na África com Nova Sede em Cape Town

Cálculo da taxa de câmbio