简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware of POSB Phishing Scams: $172,000 Lost! Protect Yourself Now

요약:Over $172,000 lost in POSB phishing scams since April. Learn how to protect yourself from banking fraud with these crucial safety tips.

Since April, phishing scams targeting POSB customers have led to at least $172,000 in losses. The police have received 13 reports related to these scams, where cybercriminals impersonate the bank to steal personal information.

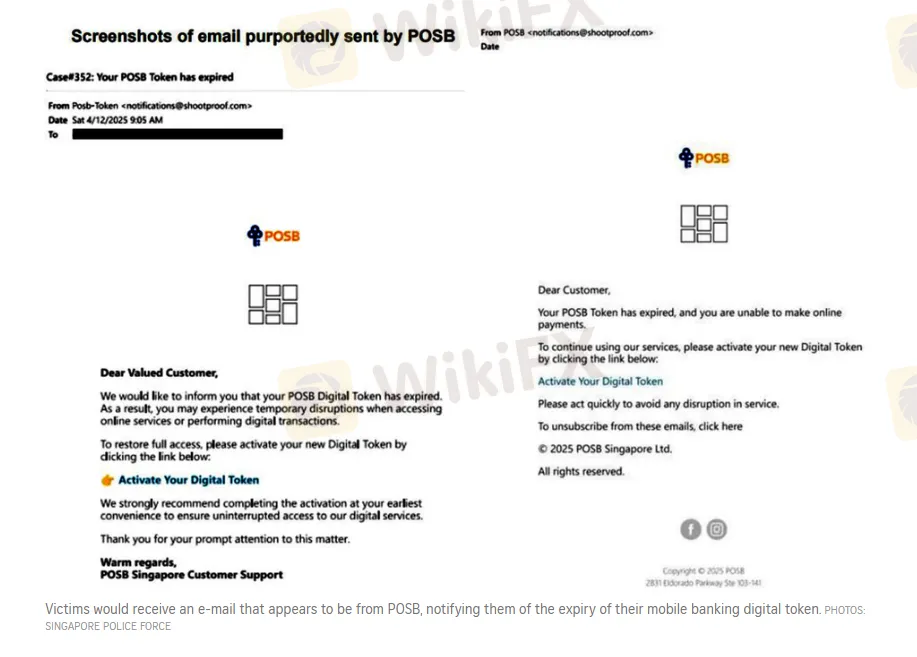

Victims receive an email that appears to be from POSB, claiming that their mobile banking digital token is about to expire. The email urges them to activate or update their token by clicking on a link provided in the message.

However, this link directs them to a fraudulent website designed to steal sensitive information. Once victims enter their banking credentials, card numbers, and one-time passwords, their accounts are compromised. Unauthorized transactions, often in foreign currencies, typically alert them to the scam.

On May 6, police issued a public warning, advising people to avoid clicking on links in suspicious emails, SMS messages, or communications from platforms like iMessage or Androids rich communication services, which claim to be from banks.

To prevent such attacks, customers are encouraged to set transaction limits on their internet banking and utilize features like Money Lock. Money Lock allows users to digitally secure their savings in an account from which no funds can be withdrawn, adding an extra layer of protection.

Singapore experienced a record $1.1 billion in scam losses in 2024, highlighting the growing threat of phishing fraud. Victims are urged to stay cautious and avoid interacting with unsolicited messages or clicking on unknown links.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

FXCM, 믿을 만한 브로커일까? | 현지본사·라이선스·이용후기·스프레드·거래속도 전격 분석

HFM 거래소 전격 분석: 안전성·수수료·라이선스·스프레드·레버리지까지 한눈에 확인

환율 계산기