简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices, NOK, CAD May Rally on Saudi Aramco Drone Strike

요약:Crude oil prices, the Norwegian Krone and Canadian Dollar may rally after a drone struck Saudi Arabias Aramco oil processing facility and sparked supply-disruption fears.

Crude Oil Prices, Saudi Arabia Output, Aramco Drone Strike– TALKING POINTS

Crude oil prices, NOK, CAD may rally early into Mondays trading session

Drone strike against Saudi Arabia Aramco sparked supply-disruption fears

Will rising political risk help buoy crude oil prices as global demand wanes?

Learn how to use political-risk analysis in your trading strategy!

Crude oil prices and petroleum-linked currencies like the Norwegian Krone and Canadian Dollar rallied early into Monday‘s trading session after reports of drone strikes at Saudi Arabia’s Aramco oil facilities in Abqaiq. The attack has disrupted their production of about 5.7 million barrels of crude oil per day, about half of the Kingdom‘s daily production of 9.8 million; to put another way: 5 percent of the world’s supply.

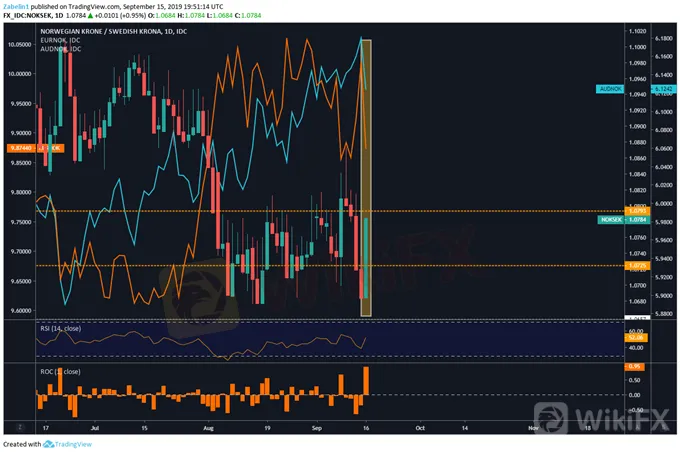

Oil-Linked Norwegian Krone Rallies Early into Mondays Trading Session Over Supply-Disruption Concerns

NOK chart created using TradingView

Yemen‘s Houthi rebels – which are widely considered to be backed by Iran – claimed responsibility for the attack. US Secretary of State Mike Pompeo condemned Tehran’s alleged involvement in the strike. This will likely amplify politically-induced supply disruption fears in the region as the prospect of reconciliation between Iran and the US is now much less likely.

According to people familiar with the matter, it could take a few weeks for Saudi Arabia to repair its facilities and resume its regular production schedule. While crude oil prices may initially spike, their upside momentum may quickly fade if Saudi Arabia draws on its reserves and if US President Donald Trump follows up on his offer to draw on the Strategic Petroleum Reserve to stabilize the energy market.

While regional political risk has helped to boost crude oil prices, it may fail to significantly alter the commoditys longer-term trajectory. Eroding fundamentals and weaker global demand have overwhelmed supply disruptions fears and political risks in Iran. Eroding fundamentals and the US-China trade war have dominating headlines and have been the primary catalyst behind the ongoing decline in crude oil prices.

Crude Oil Prices Continue to Fall Despite Rising Politically-Induced Supply Disruption Fears

Crude oil prices chart created using TradingView

CRUDE OIL TRADING RESOURCES

Join a free webinar and have your trading questions answered

Just getting started? See our beginners guide for FX traders

Having trouble with your strategy? Heres the #1 mistake that traders make

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기