简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly Fundamental Forecast:Trade Wars, GDP, Monetary Policy Active Threats Ahead

요약:While there were a number of top fundamental events on the docket this past week, the systemic themes were notably less active in the headlines.

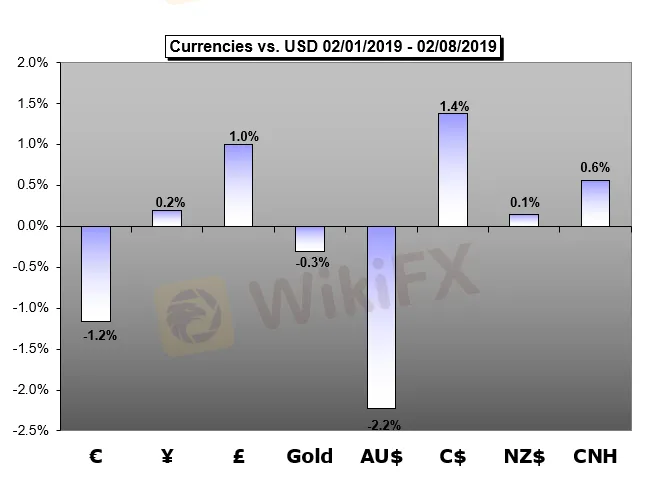

Australian Dollar Forecast – Australian Dollar Could Take Some Rest On The Road Lower

Investors may conclude this week that the poor old Australian Dollar has been hammered quite enough for now, even if there may yet be more falls to come,

New Zealand Dollar Forecast – NZD/USD Looks Vulnerable. How Dovish Will the RBNZ Turn Next Week?

The New Zealand Dollar looks vulnerable next week. How dovish will the RBNZ be next week compared to market expectations after similar remarks from the Fed, BoE and RBA.

Oil Forecast – Fears of Slowing Global Growth to Limit Further Gai

Crude oil prices came under pressure this past week in response to the return of market angst over slowing global growth and a surprising US inventory buildup of about 1 million barrels.

British Pound Forecast – Dovish BoE, Brexit Hell

A mixed bag this week with Sterling drifting lower against a strong US dollar but holding its own across a range of other currencies.

US Dollar Forecast – US Dollar May Build on Rebound as Market Mood Sours Further

The US Dollar may build on last weeks swift recovery as sentiment continues to deteriorate across global financial markets, stoking haven demand for the benchmark currency.

Gold Forecast – Bull-Flag Unfolds as Fed Warns of 'Muted' Inflatio

Fresh data prints coming out of the U.S. economy may heighten the appeal of gold should the developments dampen bets for a Federal Reserve rate-hike.

Equities Forecast – Dow Jones Looks to Trade Wars, DAX and Nikkei to GDP Data

Trade wars and economic growth will be at the forefront of concerns for equity markets across the globe next week as Germany attempts to stave off a recession and avoid tariffs.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기