简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FYERS Trading Account Types and Features

Abstract:Discover FYERS trading account options, their features, minimum deposit, and supported services. Explore trading accounts tailored for individuals, corporates, and minors.

What Types of Trading Accounts Does FYERS Provide?

FYERS offers a unified trading account structure, supported by NSE, BSE, and MCX exchanges. While it doesn't segment accounts into typical “standard” or “pro” types, it provides distinct access for retail individuals, corporate entities, and minors. All accounts include access to equity, derivatives, mutual funds, bonds, and IPOs via advanced web, app, and API platforms.

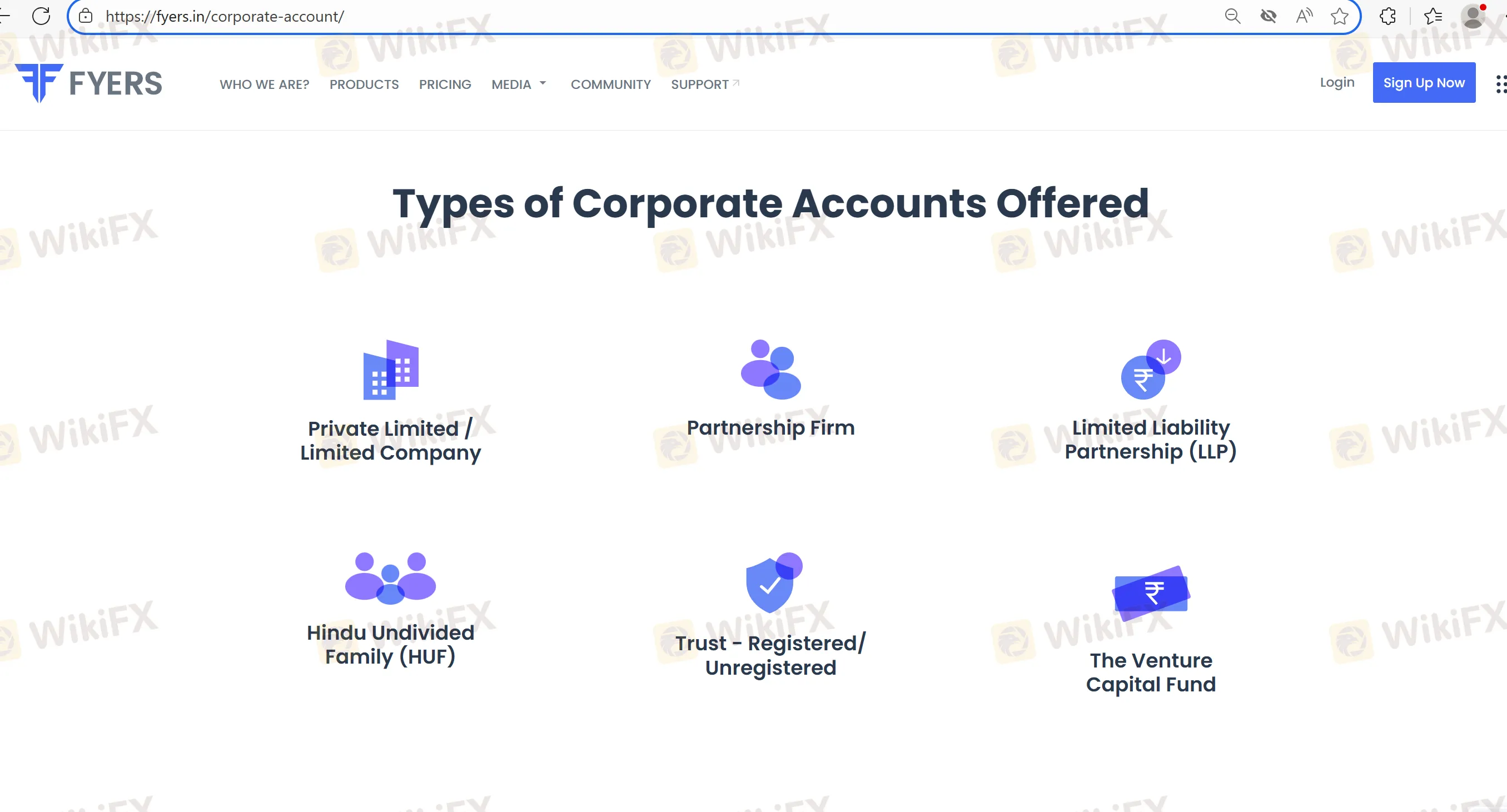

What Are the Available FYERS Account Options?

The core differences between FYERS accounts lie in user classification and supported features. Here's a detailed comparison:

| Account Type | Target Users | Key Features | Minimum Deposit | Notes |

| Individual | Retail traders/investors | Trade equity, F&O, commodities, mutual funds, IPOs | ₹0 | Online onboarding, KYC required |

| Corporate | LLPs, Pvt Ltd, Trusts | Multi-user access, API trading, pledge system, GST-compliant | Custom | Offline support required; enhanced compliance checks |

| Minor | Under-18 individuals | Guardian-controlled account, gifting shares, no buy trades | ₹0 | Transitions to individual account at 18 |

All accounts support UPI/bank funding, portfolio tracking, and reporting via “My Account”.

FAQs about FYERS Account & Trading Features

Q1: Can I open a trading account online with FYERS?

Yes, FYERS offers fully digital onboarding for individual accounts. Corporate and minor accounts require additional documentation.

Q2: Is there a minimum deposit to open a FYERS account?

No, individual accounts can be opened with ₹0 deposit. You fund only when ready to trade.

Q3: Are corporate accounts charged higher fees?

No, FYERS charges flat ₹20 per trade for all accounts unless customized under institutional terms.

Q4: Does FYERS support joint accounts?

FYERS currently only supports individual, minor, and institutional/enterprise accounts.

Q5: Can I convert my minor account to an adult account later?

Yes. Upon turning 18, the minor account must undergo KYC to convert into a regular account.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Is Learning Forex Trading Online a Good Idea? Pros and Cons Explained

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

A Guide to Buy Stop vs Buy Limit in Forex Trading

SEC Implements New Rules for Crypto-Asset Service Providers

Investment Scam Alert: FCA Identifies 15 Scam Brokers

Currency Calculator