简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Can cryptocurrencies be regarded as mortgage collateral?

Abstract:The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The move marks a potential turning point for crypto adoption in the U.S. housing market and reflects the federal governments evolving stance on digital assets.

A Boost for Crypto-Holding Borrowers

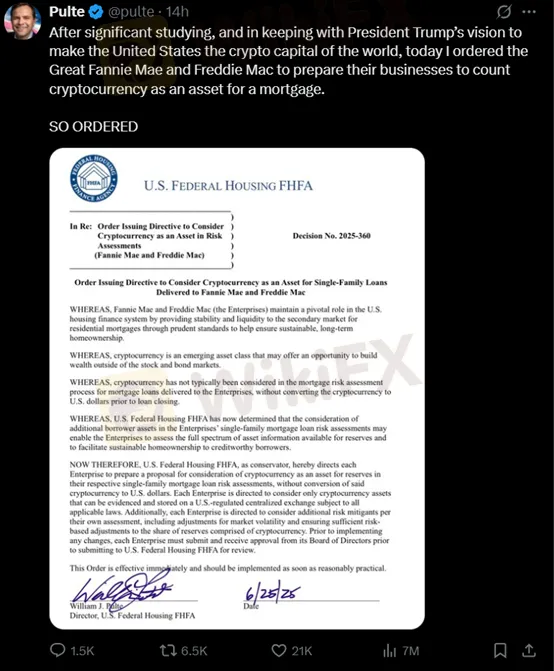

The directive, announced Wednesday by FHFA Director William Pulte via social media, signals an effort to make mortgage financing more accessible for homebuyers who hold digital assets.

“After extensive research and in line with President Trump‘s vision to make America the ’crypto capital of the world, I have directed Fannie Mae and Freddie Mac to prepare for the inclusion of cryptocurrency holdings as recognized assets in mortgage applications,” Pulte posted.

While some smaller lenders in the U.S. have previously accepted crypto as collateral, this is the first time a federal housing authority has formally acknowledged digital assets in mortgage underwriting standards.

The FHFA's move comes at a time when mortgage application volumes remain sluggish, weighed down by high interest rates and affordability challenges. By expanding the definition of eligible assets, the agency is not only increasing accessibility but also potentially stimulating loan activity in a stagnating housing market.

Analysts note that this change could unlock lending opportunities for a growing segment of digitally native borrowers who may not hold significant traditional assets but possess meaningful crypto wealth.

Unanswered Questions Remain

However, the directive stopped short of specifying which cryptocurrencies will be eligible for consideration. This lack of clarity raises questions around volatility, valuation methods, and regulatory consistency, particularly as crypto markets remain highly fluid and decentralized.

Industry experts stress the importance of clear guidelines to prevent abuse and ensure that lenders can accurately assess risk.

“This is a bold step, but the details will matter. Without standardized rules on acceptable coins, pricing models, and custody requirements, implementation will be complex,” said a senior analyst at a Washington-based financial policy think tank.

Aligning with the Trump Administration's Crypto Agenda

The FHFA‘s move aligns closely with the Trump administration’s broader agenda to promote cryptocurrency adoption across financial sectors. Since returning to the political spotlight, former President Trump has repeatedly voiced support for blockchain innovation and digital finance infrastructure in the U.S.

The decision also hints at a larger regulatory shift, where federal agencies may begin integrating crypto considerations into other forms of financial oversight and risk modeling.

Conclusion

By instructing Fannie Mae and Freddie Mac to prepare for crypto asset integration, the FHFA is signaling a historic shift in U.S. housing finance policy. While challenges around implementation, regulation, and market volatility remain, the move opens new doors for crypto-savvy homebuyers and brings the U.S. one step closer to mainstreaming digital assets.

As the details unfold, all eyes will be on how the mortgage industry responds — and whether the FHFAs bold step will usher in a new era of crypto-backed home ownership.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Complaints Against Weltrade | Traders Can’t Get Their Money Back

Opening a trading account and watching your capital grow can feel exciting and full of promise until the moment you realise you cannot get your money back. That’s when the dream turns into a nightmare. Recent complaints submitted to WikiFX reveal an unsettling pattern seen at Weltrade where deposits vanish, withdrawals stall for days or even months, and support channels lead nowhere.

WikiFX Broker

Latest News

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

How to Use Retracement in Trading

CySEC warns the public against 17 investment websites

Robinhood Moves Toward MENA Expansion with Dubai DFSA License Application

FBI Issues Urgent Warning on Crypto Recovery Scams

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

Complaints Against Weltrade | Traders Can’t Get Their Money Back

WikiFX Community Event Series, “Thailand Elites’ View”

Juno Markets: A Closer Look at Its Licenses

Germany's Industrial Core Is Collapsing Under The US Trade Deal And The Green Agenda

Currency Calculator