简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

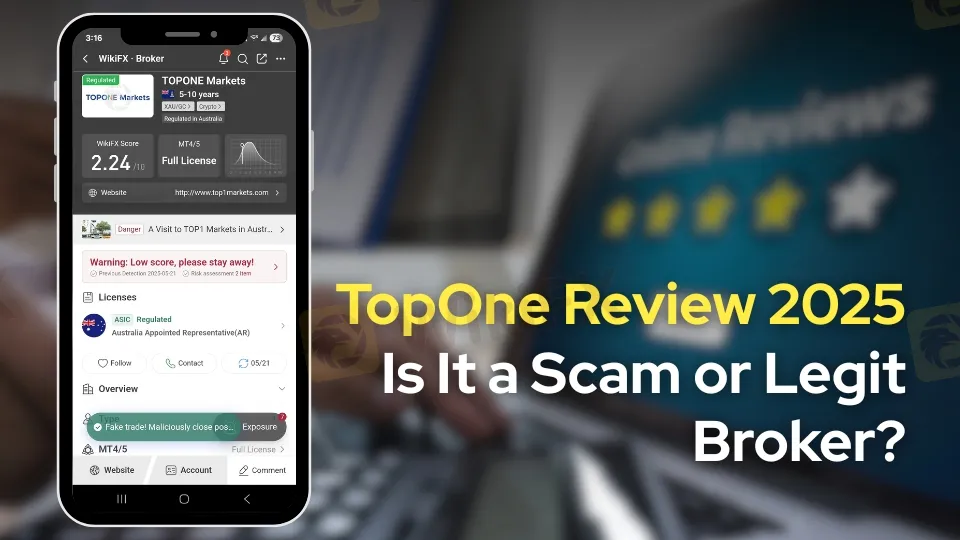

TopOne Markets Review 2025: Is It a Scam or Legit Broker?

Abstract:TopOne Markets claims to offer forex and CFD trading, but its lack of regulation, poor 2.24/10 WikiFX rating, and user complaints about withdrawals raise red flags.

TopOne Markets presents itself as a global online trading platform offering access to various financial instruments, including forex, commodities, and indices. The broker advertises competitive spreads and a user-friendly trading platform. However, a deeper investigation into its legitimacy raises significant concerns, particularly regarding regulatory compliance and transparency.

According to WikiFX, a trusted platform that rates and reviews brokers globally, TopOne Markets has a low overall rating of 2.24/10, which suggests substantial risks for traders. This score reflects issues ranging from unclear licensing to poor user feedback, signaling that potential investors should exercise caution.

WikiFX Ratings and Reviews

WikiFX gives TopOne Markets a 2.24/10 rating, classifying it as a high-risk broker. The platform categorizes the broker with the “Warning” label, which is assigned to brokers that have serious concerns, particularly relating to licensing and operational transparency.

User reviews on WikiFX are mixed but lean towards negative experiences. Common complaints include withdrawal difficulties, lack of customer support, and suspicious trading practices. For example, some users report long delays or refusal of withdrawal requests, which is a red flag for potential fraudulent activity.

The broker's transparency score and platform reliability have also been questioned, with reports of unstable trading conditions and misleading marketing claims.

For additional reviews and feedback from a diverse range of traders, please visit the following link:

https://www.wikifx.com/en/dealer/1361638425.html

Regulatory Information

One of the most crucial factors in assessing a broker's credibility and trustworthiness is its regulatory status. Trusted brokers are regulated by strict and well-established authorities known for enforcing rigorous financial standards and protecting traders' interests. These top-tier regulators include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the National Futures Association (NFA) in the USA. Brokers regulated by these bodies must comply with stringent rules related to capital requirements, fund segregation, transparency, and dispute resolution, which provide traders with a higher degree of safety and recourse in case of disputes.

In contrast, TopOne Markets presents a troubling picture:

- According to WikiFX, the broker claims to hold an ASIC license related to MT4/MT5 platforms; however, the broker can still be flagged as a suspicious broker once the service they provide is offered to areas that are not covered by ASIC.

- WikiFX explicitly states that TopOne Markets operates with “no regulation”, meaning no valid or recognized regulatory authority genuinely oversees its operations.

- Some brokers claim licenses from jurisdictions with weak regulatory frameworks or provide unverifiable license details. TopOne Markets falls into this category, lacking any authentic regulation by recognized financial watchdogs.

- Without verified regulation from strict bodies like FCA, CySEC, or NFA, traders face significant risks, including the potential loss of funds, no formal dispute resolution process, and lack of transparency.

The absence of a genuine regulatory license is a major red flag, and traders should exercise extreme caution when dealing with brokers like TopOne Markets, which fail to meet the industry's minimum standards for security and compliance.

To better understand how financial regulation works and why it matters, you can access this detailed resource from WikiFX:

How Financial Regulation Works - WikiFX

Physical Offices

TopOne Markets provides a physical office address, but this too raises doubts:

- The address listed on WikiFX appears to be generic or unverifiable.

- There is no clear evidence of an operational, staffed office at the declared location.

- Legitimate brokers usually maintain a transparent physical presence or clear contact details, which TopOne Markets fails to provide convincingly.

This lack of verifiable physical presence adds another layer of risk for potential clients.

Latest News and Social Media Insights

Recent news and social media reviews paint a mixed but largely negative picture:

- Negative news reports: Some forex watchdog websites and community forums list TopOne Markets among brokers suspected of scams or fraudulent activities.

- Social media chatter: Posts on platforms like Reddit and Facebook show traders sharing complaints about unresponsive support and withheld funds.

Below is an example screenshot of a social media post where a user warns others about withdrawal issues with TopOne Markets, underscoring community skepticism.

Caption: Social media user warns about withdrawal delays and lack of response from TopOne Markets.

Pros and Cons

Pros

- User-friendly trading platform (according to marketing materials)

- A wide range of trading instruments offered

- Competitive spreads advertised

Cons

- No verified regulation or license

- Poor WikiFX rating (2.24/10) indicating high risk

- Numerous user complaints about withdrawals and support

- Lack of verifiable physical office

- Negative social media and forum reports suggest possible scam behavior

Conclusion

Based on the available evidence, TopOne Markets emerges as a highly risky broker with strong signs of potential fraud. The absence of valid regulations, poor user reviews, and negative social media feedback all point to a broker that traders should approach with extreme caution or avoid altogether.

Investors looking for a reliable broker should prioritize those regulated by respected authorities to ensure their funds and trades are secure. The red flags identified through WikiFX and broader research strongly advise against entrusting your money to TopOne Markets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fraud Brokers List for July 2025- EXPOSED

Attention investors and traders! If you want to invest in the forex market, be careful not to choose these scam brokers. This warning list is issued by the Financial Conduct Authority.

Know the Major Risks of UbitMarkets, Before You Invest!

Scam brokers involved in the forex market who act genuine in the beginning but turn out to be frauds in the end. Choosing UbitMarkets could lead you to serious losses. Check out this article to know why we’re saying this.

What WikiFX Found When It Looked Into Decode Global

In the evolving world of online trading, regulatory oversight and physical office verification serve as two key markers for evaluating a broker’s operational integrity. Decode Global is one such entity that holds multiple licenses and has undergone location-based verification.

Dupoin: A Closer Look at Its Licenses

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Dupoin and its licenses.

WikiFX Broker

Latest News

America's Deficit Reckoning: How the U.S. debt spiral could spark a crisis

Treasury yields hold steady as Trump extends tariff deadline

Gold Prices to Fluctuate This Week Amid July 9 Tariff Deadline, Fed Policy

FCA clarifies expectations on bullying, harassment and violence to deepen trust in financial service

XS.com Expands Global Reach with Landmark Kuwait Launch

10 Unlicensed Brokers Exposed – Check Now to Stay Safe!

Exposed: Ibell Markets - A Scam Broker That Does Not Allow Withdrawals

Asia-Pacific markets mostly rise as investors assess Trump's steep tariffs

MT4 vs MT5: A comprehensive comparison in terms of functionality

Top Forex Trading Strategies for the London Session

Currency Calculator