简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Surges on Dual Tailwinds: Geopolitical Tensions and Inflation Risks

Abstract:Geopolitical Risk Boosts Safe-Haven DemandGold prices rallied over 3% earlier this week, driven by escalating tensions in the Middle East. A Houthi missile attack on Israel‘s Ben Gurion Airport and Is

Geopolitical Risk Boosts Safe-Haven Demand

Gold prices rallied over 3% earlier this week, driven by escalating tensions in the Middle East. A Houthi missile attack on Israel‘s Ben Gurion Airport and Israel’s intensified ground offensive in Gaza have raised geopolitical concerns. Meanwhile, former U.S. President Donald Trumps remark that “military means to claim sovereignty over Greenland remain on the table” has further exacerbated global instability, reinforcing gold's role as a safe-haven asset.

Macroeconomic Landscape: Inflation Persists as Growth Slows

Aprils U.S. ISM Services PMI surprised to the upside, suggesting the economy remains resilient. However, rising import prices due to new tariffs are fueling higher input costs, particularly in the food and hospitality sectors. This has reignited fears of stagflation—stagnant growth coupled with persistent inflation.

Markets now turn their attention to the May 7 FOMC rate decision. Despite Trumps continued criticism of Fed Chair Jerome Powell for being “too rigid” and his calls for an immediate rate cut, the CME FedWatch Tool suggests no rate change is expected this Wednesday. The Fed is likely to maintain a “wait-and-see” approach, seeking more data before adjusting its policy stance.

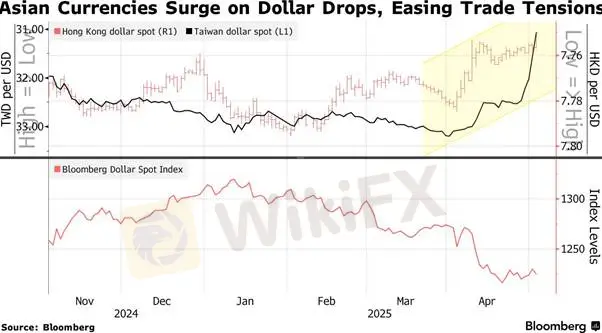

Weaker Dollar Fuels Asian Currency Surge

A softer U.S. dollar and growing recession expectations have altered the risk-return outlook for dollar holdings in export-driven economies. According to Goldman Sachs, Asian currencies including the Chinese yuan, New Taiwan dollar, and Malaysian ringgit have all shown sustained appreciation.

CFTC data reveals that speculative short positions on the dollar have surged to their highest levels since September 2023, reflecting rising bearish sentiment.

Image Source: Bloomberg – Collective Surge in Asian Currencies

Capital is flowing out of U.S. assets and into Asian markets, prompting an extraordinary rally in regional currencies. Bloombergs Asia Dollar Index posted its largest weekly gain since 2022, with the New Taiwan dollar soaring 6.5% in just two days—the sharpest move since 1988. The Hong Kong dollar, Chinese yuan, and South Korean won have all hit multi-month or yearly highs, forcing central banks across Asia to step in and stabilize exchange rates.

Conclusion: Triple Support for Gold Remains Intact

Gold continues to benefit from three powerful catalysts: global geopolitical uncertainty, capital reallocation, and an unclear U.S. policy outlook. While the $3,400 level presents short-term technical resistance, gold remains attractive as a “real-world risk anchor” amid ongoing market uncertainty. Should the Fed hold rates steady this week and inflation or geopolitical tensions escalate further, gold could retest previous highs.

Gold Technical Outlook

Gold prices jumped sharply from around $3,250 to $3,380, breaking past key resistance levels and signaling strong bullish momentum. The Relative Strength Index (RSI) remains above 70, indicating overbought conditions. However, this does not necessarily imply a trend reversal; rather, it often reflects the “momentum phase” of a bullish run.

If gold remains above $3,350, it could test the next resistance at $3,400, and potentially challenge the prior high near $3,430. Key support lies at $3,263 and $3,220. A break below these levels may trigger a technical pullback.

Key Levels

Resistance: $3,263–3,270, $3,350/oz

Support: $3,200–3,220/oz

Risk Disclaimer: The views, analysis, research, prices, or other information presented above are for general market commentary only and do not constitute investment advice. All investors are responsible for their own decisions. Please exercise caution when trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Meta Cracks Down on Scam Networks Targeting Brazil and India

Clicking on a Facebook Ad Cost Him His Life Savings of RM186,800

Are You Trading or Are You Gambling?

EUR/USD at a Critical Juncture: Can the 1.13 Level Hold?

Essential Features to Look for in a Trading Platform

Unlocking Forex Profits: Your Guide to Smart Currency Trading

Why Digital Assets Are Surging Today?

Fraud Claims Rise Higher Than Ever Against Trading Platforms

Exposing the Dark Art of Pig Butchering Scams

ASIC Launches Streamlined Digital Platform for AFS Licensing

Currency Calculator