简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

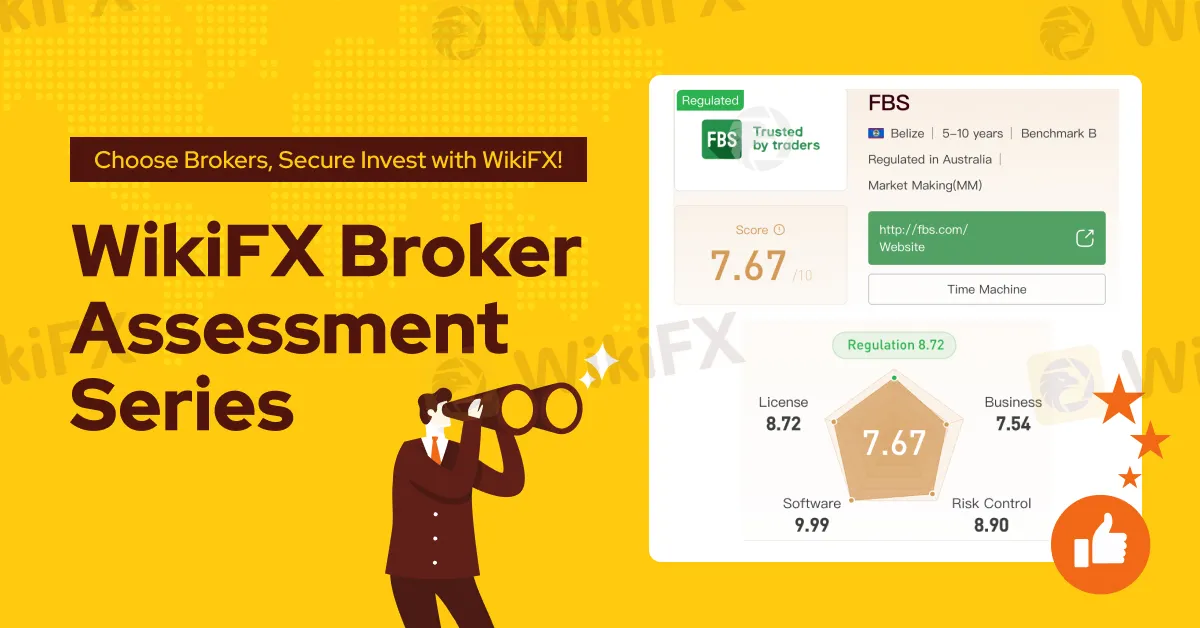

The Most Comprehensive Review of FBS in 2025

Abstract:This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

Basic Introduction

FBS is an internationally recognized broker with a significant presence in Asia, offering a variety of trading instruments such as forex, stocks, indices, energy, and metals. With over 90 international awards, FBS serves 27 million customers in 150 countries, earning a stellar reputation globally.

The company offers flexible trading conditions, floating spreads starting from 0.7 pips, commission-free trading, and fast execution speeds from 0.01 seconds. FBS ensures customer safety with negative balance protection and provides a user-friendly experience on familiar trading platforms.

Features

FBS offers negative balance protection, ensuring users are not exposed to the risk of losing more than their account balance due to market fluctuations. The platform also provides various trading tools to meet the needs of different traders, whether they are beginners or experienced investors. To further enhance the user experience, FBS offers 24/7 customer support, answering queries and providing assistance as needed.

Fees

FBS offers flexible trading conditions for traders, allowing up to 500 open positions, including 200 pending orders. The leverage is adaptable to suit traders with different risk preferences. The minimum deposit is just $5, making it accessible for beginners. The order volume ranges from small to large positions, accommodating various trade sizes.

Trading Platforms

FBS provides multiple platforms, including MetaTrader 4, MetaTrader 5, and the FBS App.

The FBS App offers a convenient tool for investors to analyze market trends using easy-to-use charts, manage orders, and access the market anytime, anywhere. Investors can start trading quickly with a simple registration process, streamlined verification, and easy deposit options. With just one click, investors can view account equity, margin, available margin, and floating P&L to assess trading opportunities.

No matter where they are, investors can access charts and customize them according to their needs. By utilizing more than 90 indicators, they can identify price trends and make informed trading decisions.

Product Range

FBS offers a range of core products, including forex and stocks, to meet the primary investment needs of most individual investors. These products provide flexible investment options suitable for different types of traders.

To learn more about the reliability of a particular broker, you can visit our website (https://www.WikiFX.com/en) or download the WikiFX app, which helps you find the most trustworthy brokers, ensuring safer and more reliable trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Dollar Keeps Falling: How Should We View Exchange Rate Volatility?

The U.S. dollar continues to weaken, triggering ripple effects across global markets. Beneath the currency’s depreciation lies a deeper crisis in its credibility, institutional foundation, and global financial status.

Are Trading Courses and Mentors a Fast Track or a Financial Trap?

In recent years, trading has become more popular than ever. Social media is full of people showing off their “trading lifestyle” with expensive cars, luxury holidays, and promises of easy money. Many of them claim to be mentors, investment coaches, or run online trading academies. They say they can turn beginners into full-time traders in just a few weeks. But is it true, or is it just a clever scam?

Gold Prices Pull Back, Near Four-Week Low Amid Easing Risk Sentiment

As risk aversion fades and investors turn their attention to U.S. inflation data, gold prices retreat sharply, falling to their lowest levels in nearly a month.

Using Any of These Illegal Forex Trading Apps? Stop Before It Turns into a Crisis

The Reserve Bank of India (RBI) has listed out some illegal forex apps India. Read this article to know some of those apps.

WikiFX Broker

Latest News

The Shame of Being Scammed: Don't Ever Stay Silent

Citibank Sued in $20M Romance Scam Tied to Fraudulent Transfers

Treasury yields inch higher as investors await the Fed's preferred inflation print

Capital.com Launches $1 Million EU Client Insurance to Enhance Investor Safety

The five most investment-risky brokers in Malaysia

Think Before You Trade! Unlicensed Brokers List Inside

IC Markets Sponsors AEL Limassol, Football Club Until 2027

5 Reasons to Stay Away from Core Prime Markets

Core inflation rate rose to 2.7% in May, more than expected, Feds preferred gauge shows

Core inflation rate rose to 2.7% in May, more than expected, Fed's preferred gauge shows

Currency Calculator