简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why a Broker’s Customer Service Matters More Than You Think

Abstract:Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Responsive customer service is not just a bonus; it is a sign of reliability. A broker that answers questions quickly shows they care about their clients. They help resolve issues like login errors, deposit delays, or sudden changes in trading conditions. On the other hand, brokers that fail to respond on time can leave traders stuck. This affects not just their trading performance but also their peace of mind.

Poor customer service can also violate traders rights. When issues are ignored, traders lose time and money. For example, if a trade gets stuck due to a technical glitch, every second counts. If the broker does not act fast, the trader may face losses. Over time, this could ruin their trading account.

Many traders underestimate this risk. They think regulation is the only thing that matters. But even regulated brokers can have slow or unhelpful support. This is why traders must do more research before choosing a broker.

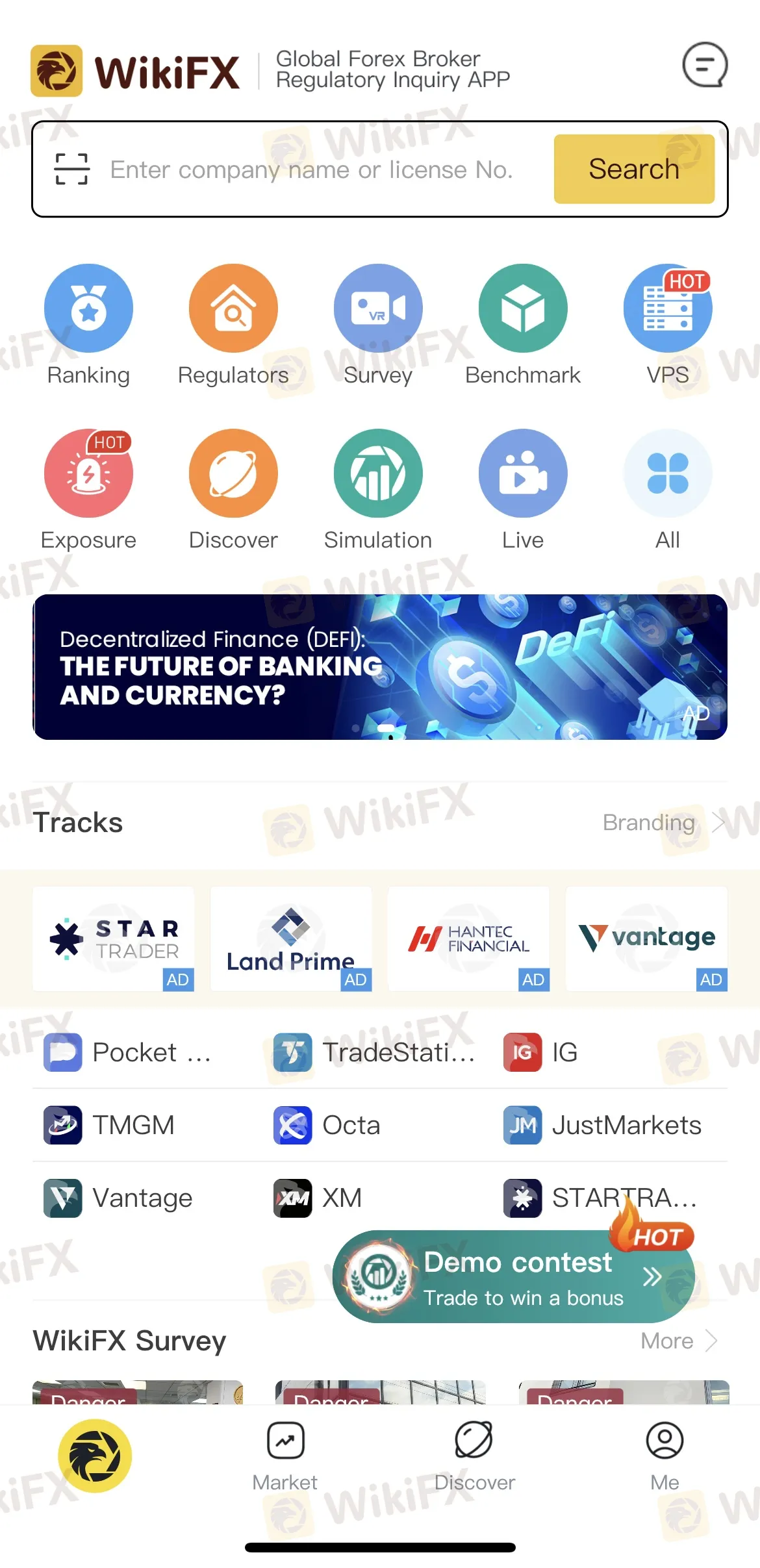

One of the easiest ways to check a brokers reliability is by using the free WikiFX mobile app. This app provides detailed reviews and ratings of brokers. It also shows whether a broker is regulated. More importantly, traders can see feedback from other users about customer service. This information helps traders make a better decision, at no cost.

Choosing a broker is a big step. Traders should not rush this process. A reliable broker with good support can make a huge difference. They can protect traders from unnecessary risks and help them perform better.

In conclusion, dont ignore customer service when picking a broker. A lack of support can lead to problems and even losses. Take the time to research brokers carefully. Use tools like WikiFX to check reviews and ratings. This simple step can save you a lot of trouble.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

In the volatile world of forex trading, risk is inevitable. One widely used strategy is forex hedging, which is a useful technique designed not to eliminate risk entirely, but to reduce its potential impact. As global economic uncertainty persists, understanding how hedging works could be an essential addition to a trader’s toolkit.

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

Truth About Angel One – Here’s What You Need to Know

Thinking about investing in Angel One? Wait! Know the essential things about the broker before Invest. It could be SCAM. Read, think, and invest .

WikiFX Broker

Latest News

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

OPEC+ members agree larger-than-expected oil production hike in August

Top Wall Street analysts are pounding the table on these 3 stocks

Stock futures fall after Trump team says tariffs will go into effect on Aug. 1: Live updates

FCA clarifies expectations on bullying, harassment and violence to deepen trust in financial service

Asia-Pacific markets set for mixed open after Trump shifts goalposts on tariffs again

CNBC Daily Open: Most people don't start a political party after separation

Asia-Pacific markets mostly lower after Trump shifts goalposts on tariffs again

Currency Calculator