简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

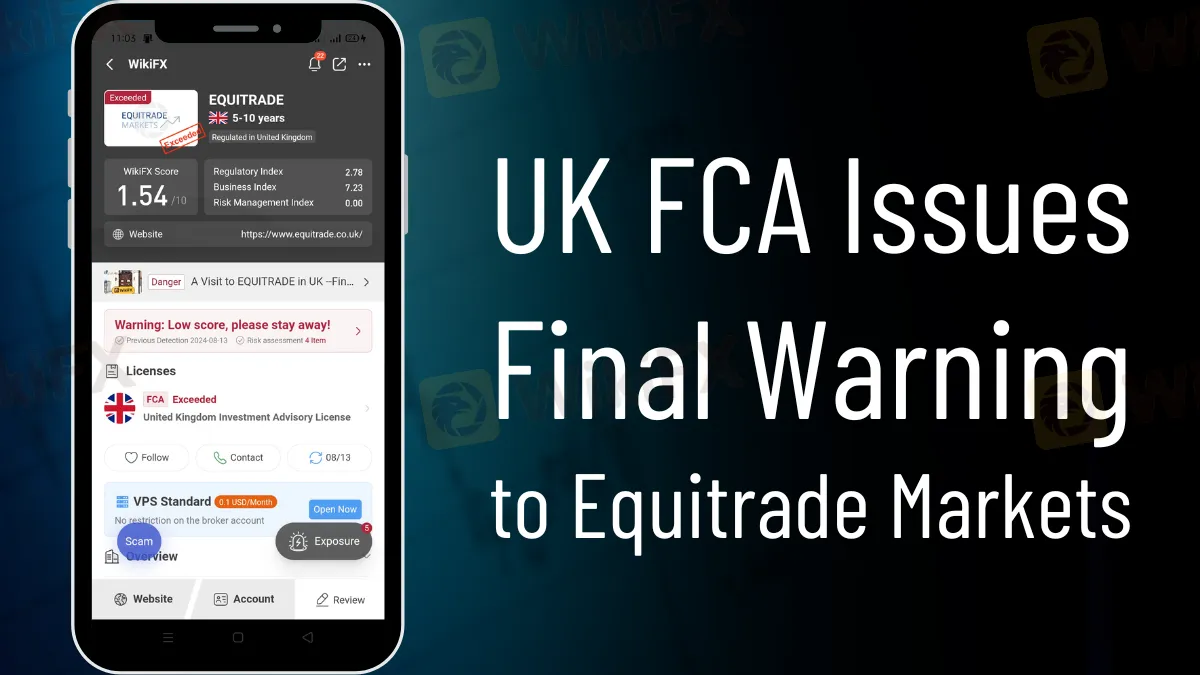

UK FCA Issues Final Warning to Equitrade Markets

Abstract:The UK FCA has issued a final warning to Equitrade Markets, revoking its license due to serious regulatory breaches and lack of compliance.

The UK Financial Conduct Authority (FCA) has taken serious action against Equitrade Markets Ltd, issuing a Decision Notice revoking the firm's Part 4A authorization. This decision comes after the FCA conducted a comprehensive investigation and determined that Equitrade Markets has continuously failed to fulfill the regulatory criteria necessary to operate as a financial service provider in the UK.

The FCA's decision is based on concerns that Equitrade Markets does not meet the appropriateness Threshold Condition, which is a key criterion for all regulated organizations. The Authority found that the business is not a “fit and proper” entity, owing to its inability to conduct its activities soundly and responsibly. This conclusion demonstrates the FCA's commitment to ensuring that all enterprises under its authority operate honestly and responsibly.

One of the primary points raised by the FCA is Equitrade Markets' continuous inability to comply with the regulatory duty to submit the requisite Returns. Despite several inquiries from the FCA, the business failed to meet its duties, indicating a lack of transparency and collaboration. This non-compliance immediately breaches Principle 11 of the FCA's Principles for Businesses, which requires enterprises to be open and helpful with the regulator.

The FCA's final warning underscores that Equitrade Markets' major shortcomings, notably in terms of suitability, have led to the unavoidable conclusion that the company is not conducting its business in a way that guarantees its affairs are handled appropriately. As a result, the FCA found that Equitrade Markets did not fulfill the Threshold Conditions for having a Part 4A permit and, therefore, canceled its license.

In parallel, industry watchdog WikiFX has been aggressively monitoring companies like as Equitrade Markets. The broker presently has a poor WikiFX rating of 1.54, which reflects its lack of regulation and failure to renew its FCA licence. WikiFX's continual efforts to identify untrustworthy brokers give useful information for investors, allowing them to make more educated selections.

Note of Awareness

Investors should use care when engaging with financial service providers. Before participating in financial activities, it is essential to establish a firm's regulatory status.

About WikiFX

WikiFX is a worldwide broker regulatory inquiry tool that offers detailed information on brokers, including regulatory status and client comments. WikiFX seeks to safeguard investors by providing clear and trustworthy information on financial service companies globally.

Concerned about your investments? Check the regulatory status and reviews of Equitrade Markets brokers on WikiFX to make informed decisions and protect your assets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Pull Back, Near Four-Week Low Amid Easing Risk Sentiment

As risk aversion fades and investors turn their attention to U.S. inflation data, gold prices retreat sharply, falling to their lowest levels in nearly a month.

Using Any of These Illegal Forex Trading Apps? Stop Before It Turns into a Crisis

The Reserve Bank of India (RBI) has listed out some illegal forex apps India. Read this article to know some of those apps.

IC Markets Sponsors AEL Limassol, Football Club Until 2027

AEL Limassol has renewed its deal with IC Markets (EU) Ltd, who will stay as the team’s Gold Sponsor until 2027. The sponsorship deal was first announced for the 2025–2026 season, but it has now been officially extended until 2027.

5 Reasons to Stay Away from Core Prime Markets

The Forex market is a very unpredictable, complex, and risky place. There are many brokers that appear genuine but can steal your hard-earned money. So, staying alert is the only way to survive in this dynamic environment. Therefore, in this article, we are sharing 5 warning signs about Core Prime Markets.

WikiFX Broker

Latest News

Asian chip stocks rise after Nvidia reclaims title of the world's most valuable company

Nvidia's comeback sparks a rally in Asian chip stocks

CNBC Daily Open: Despite all the uncertainty, the S&P 500 is flirting with record highs — strange times

PU Prime and AFA Announce Partnership at Madrid Event

eToro UK Launches 4% Stock Cashback Card: Earn Up to £1,500 Monthly

EBC Expands ETF CFD Offering & Copy Trading Education Partnership

Gold Prices Continue to Fall as Israel, Iran Agree on Ceasefire

China steps up push to internationalise the yuan as global dollar dominance wavers

Multibank Group Offices: Global Presence and Contact Info

ESMA Proposes Reporting Reforms That Could Cut Costs for Forex Brokers

Currency Calculator