简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The victim is unable to withdraw money both capital and profit after investing in UEZ Markets

Abstract:This article sheds light on the plight of an investor who finds themselves unable to withdraw both their capital and profits after investing in UEZ Markets.

About UEZ Markets

UEZ Markets is a forex broker that was founded in 2018. It is regulated by the Australia Securities & Investment Commission (ASIC, No. 001300519). UEZ Markets offers a variety of trading instruments, including Forex, Metals, Energies, Crypto, and Indices through the MT5 trading platform. This broker does not hold a legitimate license, we could not consider this broker a reliable broker. Thus, we hope all traders understand the risk of investing in this broker.

The Case in Details

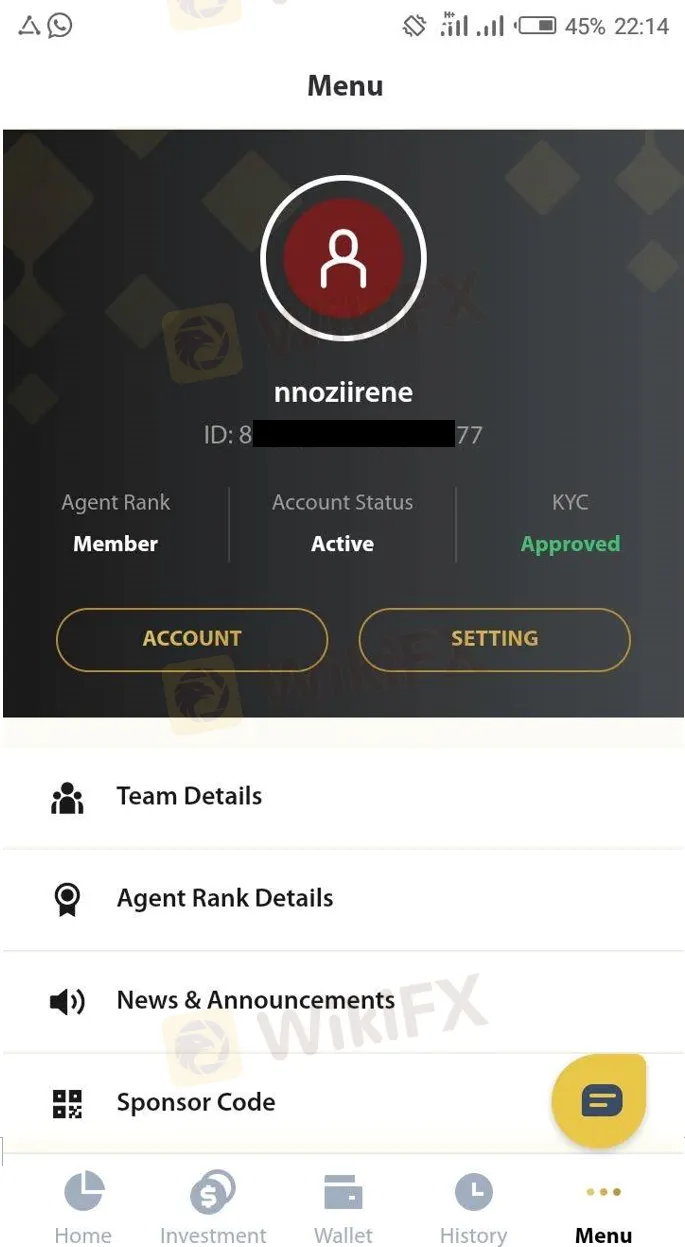

On March 27, 2023, The trader decided to invest $1000 with UEZ Markets, a broker promising consistent monthly profits ranging from 5-6% of the invested capital. The allure of such gains, coupled with the assurance of being able to withdraw both the profits and the initial investment, enticed the victim to take the leap. To legitimize their engagement, UEZ Markets issued investment certificates, labeling them as “Term Managed Account” (TMA), seemingly to establish an air of credibility around their services.

The Red Flag

As time progressed, the victim's investment reportedly yielded profits as promised. With a sense of accomplishment, the investor initiated a withdrawal request to access their accrued profits and capital. To their shock and dismay, UEZ Markets declined the withdrawal request, citing an inability to process the transaction. This red flag sparked concerns about the legitimacy and reliability of the broker, leaving the victim in a state of financial limbo.

Faced with the predicament of being unable to withdraw both the profits and the invested capital, the victim turned to WikiFX for assistance. WikiFX, a platform that provides information and ratings about forex brokers, is often sought after by investors seeking clarity and redress. The victim's hope lies in WikiFX's ability to investigate the matter, potentially helping them recover their invested funds.

Conclusion

Investing is a double-edged sword; it can bring substantial returns, but it also carries risks. The tale of the victims unable to withdraw their capital and profits from UEZ Markets underscores the importance of research, due diligence, and cautious decision-making in the investment realm. It also highlights the necessity for robust regulatory frameworks to prevent instances of fraud and protect investors' rights. As the victim seeks assistance from platforms like WikiFX, the hope remains that they will find a solution to their ordeal and serve as a cautionary tale for others considering similar investment paths.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | TOPONE Markets: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of TOPONE Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Interactive Brokers Adds Ping An of China ETF to No-Fee Program

Interactive Brokers now includes Ping An of China CSI HK Dividend ETF in its no-transaction-fee program, offering investors low-cost access to Hong Kong’s top dividend-paying stocks.

eToro Broker Review: Something You Need to Know

As a reputable broker that has offered services for decades, eToro has played a significant role in the industry. However, it doesn’t mean it suits every trader. Besides, WikiFX has recently received more than 40 complaints against a broker called eToro. In today’s article, we will offer you a comprehensive review of this broker so that you can have a close overall look at eToro.

Judge Reviews Sanctions Against CFTC in My Forex Funds Fraud Case

A New Jersey judge reviews sanctions against the CFTC after a special master accused the agency of bad faith in its fraud case against My Forex Funds and CEO Kazmi.

WikiFX Broker

Latest News

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

Radiant DAO Proposes Compensation Plan for Wallet Losses

BitGo Secures MiCA License, Expands Crypto Services Across the EU

Big Changes at Saxo Bank: What Traders and Partners Need to Know

Traders Warned to Stay Alert Amid Growing Exposures for INGOT Brokers

WELTRADE's transformation from Reliable to a Problematic Broker

WikiFX “Elite’s View on the Challenge: Dialogue with Global Investment Leaders” Concludes Successful

Plus500 Review 2025: Trusted CFD Broker with Top Features Unveiled

Plus500 Q1 2025: Strong Growth Amid Trade War, Mehta Acquisition

Currency Calculator