简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asia's Best Morning Nibbles

Abstract:In the event that the markets required any further justification to fear, today is Friday the 13th.

Click Here: After you read it, Daily Routine with WikiFx

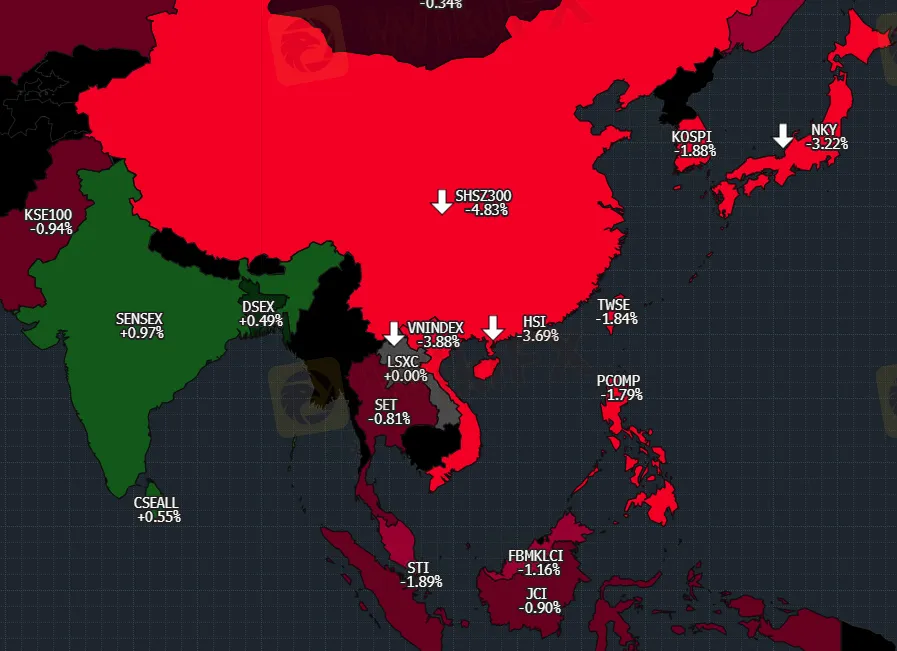

The S&P500 and the NASDAQ both finished flat yesterday, after a bumpy session with large swings in both directions. The benchmark FX index, EURUSD, fell to fresh lows of 1.0380 from 1.05s yesterday. The AUD fell to 0.685, while the JPY retreated to 128.50. Except for the JPY, Asian FX fell against the USD yesterday, with the CNY continuing its current drop. Treasury yields fell again, 2s over 10s. In May, 10Y US Treasury yields peaked at 2.86 percent, down 36bps. Have US treasury yields peaked for this cycle? Discuss… I'm curious about your ideas... I'm not sure, but it's worth thinking...

The US University of Michigan consumer confidence index and associated inflation expectations gauges are calm today. Powell and Daly have reiterated that the next FOMC meetings will provide 50bp raises, not 75bp, but this does not seem to be enough to calm the markets. We'll watch how Kashkari does today on oil and inflation.

India's April CPI came in at 7.8% YoY, above the average projection of 7.4%. The upside surprise was mainly due to food, but also to fuel and light, transportation (all reflecting higher energy prices), and apparel. Given the RBI's recent 40bp boost, it's worth pondering if the next move should be 50bp.

Today is also India's trade data. With local economic strength and higher-cost imported commodities, the market consensus is for the deficit to widen to -$20bn.

Beijing residents will be home for three days for Covid testing. Although not a “lockdown,” the economic repercussions will be similar. The zero-Covid policy holds true. A lockdown's economic impact is difficult to assess due to time and duration uncertainties Heavy rains have flooded Guangdong province. This may also impact factory operations, further hindering manufacturing and exports.

This budget includes 36.4 trillion won for the central government and 70% for small business owners. Each cash transfer is 6-10 million won (USD450-800). The remaining 23 trillion won will go to local governments. No bonds are needed because the budget is financed by 53 trillion won in extra tax income and spending restructured. Better supply conditions are expected to help the bond market. However, higher-than-expected government spending could push the CPI prediction for 2022 up to 4.6%, triggering more aggressive monetary tightening. For now, we expect the Bank of Korea to keep interest rates at 2.25 percent.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposing Profit Trade: Profit Only Exists in Its Name, Not During Trade

If there was ever a forex scammer to be alert of, Profit Trade emerges as the first one. The Bulgaria-based forex broker has been annoying investors by denying their withdrawal requests, suspending their account without any reason, and unfulfilled promises.

Think Twice Before Choosing UC Markets –Know the Risks

Forex trading has become increasingly complex and risky, especially for newcomers. While the foreign exchange market still offers legitimate opportunities for traders and investors, but investment scams have now become common. Fake brokers are widespread, and spotting them can be extremely difficult . The only way to safeguard your capital is to stay informed and alert. In this article, we’ll break down the red flags of UCMarkets and explain why you should avoid it .

WikiFX Broker Assessment Series | FXBTG: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of FXBTG, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

What WikiFX Found When It Looked Into CORSA FUTURES

Online trading is growing fast, but so are the risks. It's more important than ever to choose brokers that are transparent, regulated, and trustworthy. One broker raising concerns is CORSA FUTURES. According to WikiFX, a platform that checks broker credibility, CORSA FUTURES has a very low score of 1.29 out of 10. This low rating suggests serious issues with the broker's trustworthiness. Keep reading to learn more about this broker

WikiFX Broker

Latest News

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Sharing Trading Mistakes and Growth

Trading Market Profile: A Clear and Practical Guide

Eyeing Significant Returns from Forex Investments? Be Updated with These Charts

CNBC Daily Open: The silver lining of positive earnings could be too blinding

CNBC Daily Open: Solid earnings beats might mask tariff volatility these two weeks

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

Jeep-maker Stellantis expects first-half net loss of $2.7 billion as tariffs bite

Currency Calculator