简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil Rally May Stall on China Covid Woes, Fed Rate Hikes

Abstract:WTI crude and Brent crude oil prices rocketed higher in the first quarter of the year as Covid-related lockdowns and restrictions were rolled back across major economies, fueling a surge in demand.

WTI crude and Brent crude oil prices rocketed higher in the first quarter of the year as Covid-related lockdowns and restrictions were rolled back across major economies, fueling a surge in demand. That increase in demand quickly outpaced rising supply levels. Then, in February, Russia invaded Ukraine. A volley of Western sanctions followed, effectively severing Russias connection to global financial markets. The United States and Britain moved to ban Russian oil exports, although the European Union refrained, fearing an energy crisis.

Still, the confusion around quickly evolving sanctions as well as the removal of Russian banks from the SWIFT messaging system has made buyers and foreign shippers hesitant to take delivery from Russian ports. Although not formally targeted by much of the Western alliance, Russias oil industry, which supplies around 10 million barrels per day to the global market, was thrown into chaos. Oil prices responded with Brent crude oil hitting its highest level since 2008.

However, there is potential for a near-term pullback even as demand around the world picks up. That pullback may come if Ukraine and Russia negotiate an end to the war. Such negotiations could lead to a removal of some Western sanctions, potentially reopening the taps on Russias energy products, at least to a degree. Outside of the supply factor, an end to the war would also remove the geopolitical risk premium in prices.

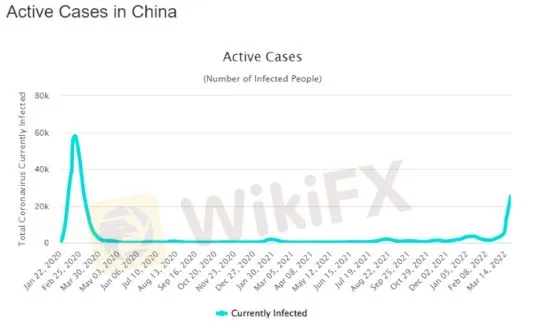

There also exists a chance that the energy market‘s demand-side may ease due to a Covid outbreak in China. A drop in demand for Asia’s largest oil consumer would likely be followed by a contraction in imports, easing pressure on strained supply capacity. China is reportedly soaking up some of Russias new spare capacity, but it still sources much of its oil from other countries.

The Beijing auto show that was scheduled for late April was canceled amid Chinas worst Covid outbreak since the pandemic began. Other major events in China are likely to suffer the same fate until the outbreak is contained. Widespread cancellations would open the door for a pullback, with bearish factors compounded by the chance for a more aggressive 50 basis point rate hike from the Federal Reserve in May.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Rate Today in Mumbai and Other Updates on Your Fingertips

After correcting for two straight days, gold rebounded on June 26, 2025, across 24 Karat and 22 Karat categories in Mumbai, the financial capital of India. Check out the latest price update.

A Guide to RBI Forex Rules in India

To ensure transparency, the Reserve Bank of India (RBI), which regulates the country’s foreign exchange market, places certain rules on buying and selling currencies and other transactions.

Israel-Iran Conflict: Oil Markets in Focus as Iran Contemplates Strait of Hormuz Closure

Explore this story to know the impact on oil markets should Tehran close the Strait of Hormuz amid the Israel-Iran conflict.

Govt Imposes Import Curbs on Precious Metal to Stop Liquid Gold Inflow

As the illegal inflow of gold rose in India, the government has decided to impose import curbs on various colloidal precious metals. Check out our story on this.

WikiFX Broker

Latest News

Asian chip stocks rise after Nvidia reclaims title of the world's most valuable company

Nvidia's comeback sparks a rally in Asian chip stocks

CNBC Daily Open: Despite all the uncertainty, the S&P 500 is flirting with record highs — strange times

PU Prime and AFA Announce Partnership at Madrid Event

eToro UK Launches 4% Stock Cashback Card: Earn Up to £1,500 Monthly

EBC Expands ETF CFD Offering & Copy Trading Education Partnership

Gold Prices Continue to Fall as Israel, Iran Agree on Ceasefire

China steps up push to internationalise the yuan as global dollar dominance wavers

Multibank Group Offices: Global Presence and Contact Info

ESMA Proposes Reporting Reforms That Could Cut Costs for Forex Brokers

Currency Calculator