简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price News and Forecast

Abstract:XAU/USD looks to retest $1,750 as risk dwindles

The price of gold is on the backfoot despite a weaker US dollar at the start of this week and the prospects are for a significant correction to the downside.

Failures at resistance have so far proven to draw in additional bearish flows and speculative shorts.

TECHNICAL ANALYSIS

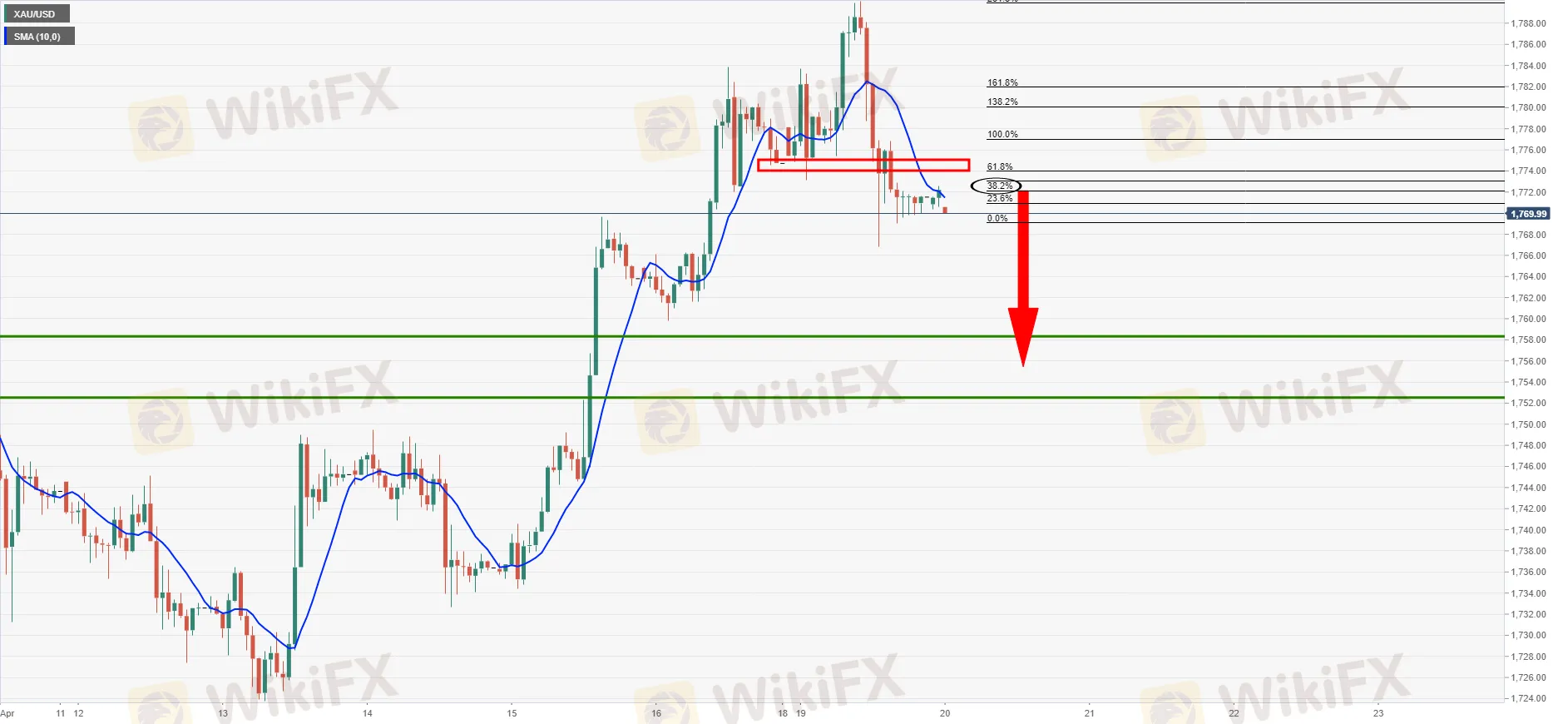

Gold, daily chart

The bulls are facing a wall of resistance and the price could be drawn to a restest of the prior support and a 61.8% Fibonacci retracement.

Bears can engage from below hourly resistance.

Gold, hourly chart

Bears are in control below the hourly resistance after making a 38.2% Fibonacci retracement of the latest bearish impulse.

POPULAR GOLD BROKER LIST

AvaTrade

XTB

BDSwiss

OctaFX

FXCM

FP Markets

FXTM

Plus500

Tickmill

Stay tuned as WikiFX will bring you with more Forex news updates!

╔═══════════════════════╗

Website: https://bit.ly/wikifxIN

APP for Android: https://bit.ly/3kyRwgw

APP for iOS: https://bit.ly/wikifxapp-ios

╚═══════════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Short or Long Term: Which to Choose for Double-Digit Returns from Gold Investments?

Everyone is asking - whether I should invest in gold for the short or long term given the recent surge? Explore this guide to know how gold has performed over the years, its outlook, and more details.

Gold Soars Above $3,350 as XAU/USD Rallies on Trade Tensions

Gold (XAU/USD) surges past $3,350 amid renewed trade tensions and safe-haven demand. Discover the latest price action, technical levels, and market drivers.

Revealing Factors That Help Determine the Gold Price in India

Want to know why gold prices differ from one place to another in India? It's because of these top reasons. Read this interesting gold story.

Gold Prices to Fluctuate This Week Amid July 9 Tariff Deadline, Fed Policy

Gold prices are likely to fluctuate sharply this week as traders keep a close eye on the announcements regarding the US import tariff policy, US Federal Reserve’s take on interest rate cuts, etc. Know in detail the gold price forecast.

WikiFX Broker

Latest News

FCA to modernise rules to unlock investment

Wondering Why Your International Earnings Come Less Than Expected? It's Because of Forex Markup Fees

How Fake News Sites Are Fueling a Global Investment Scam Epidemic

Alchemy Markets: A Closer Look at Its Licenses

10-year Treasury yield ticks lower after core CPI comes in slightly lightly lower than expected

From Novice to Pro: Why Investors Trust Land Prime?

Labubu craze to drive up profit 350%, China\s Pop Mart says

Goldman Sachs is set to report second-quarter earnings — here's what the Street expects

PrimeXBT Launches MT5 PRO Account for Active Traders

CNBC Daily Open: Inflation in the U.S. hit a four-month high in June — as expected

Currency Calculator