简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Planning to Invest in Trade245? Read These Negative Trader Reviews First!

Abstract:Setting your sights on Trade245? Think again! Traders are witnessing massive problems that extend beyond withdrawal denials. The issues include blown-up accounts due to trading manipulation, along with high spreads and commissions. As a result, traders witness only losses even when they are not supposed to. This has made the situation highly complicated for them. In this article, we have exposed Trade245 for its financially illicit acts. Read on!

Setting your sights on Trade245? Think again! Traders are witnessing massive problems that extend beyond withdrawal denials. The issues include blown-up accounts due to trading manipulation, along with high spreads and commissions. As a result, traders witness only losses even when they are not supposed to. This has made the situation highly complicated for them. In this article, we have exposed Trade245 for its financially illicit acts. Read on!

Complaints Against Trade245 That Need Addressing

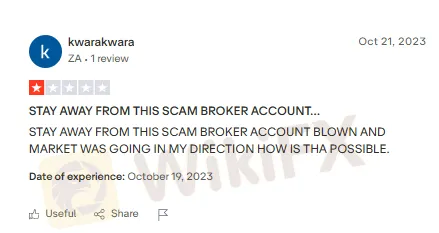

Traders Bothered by Account Blown Up Issue

Trading manipulation is extreme at Trade245. Trader accounts get blown away even when the market is in their favor. This appears to be deliberate manipulation by the company. Check out this screenshot that supports the complaint.

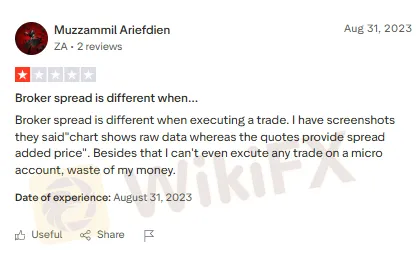

Spread Varies When Executing a Trade

To acquire customers, Trade245 keeps a reasonable spread. However, as customers start trading, the spread varies and goes up, worsening their trading experience. Here is one trader making such a complaint.

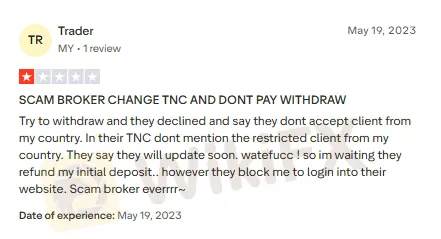

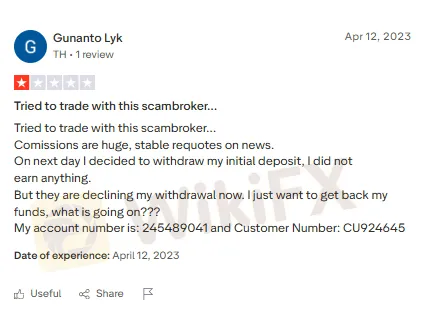

Illegitimate Withdrawal Denials

Trade245 has plenty of illegitimate reasons to deny access to withdrawals. In one complaint, the trader was denied withdrawal because he was residing in a restricted list of countries. However, the trader stated that the company does not have this mentioned in the terms and conditions. There is one more complaint wherein one trader stated about high commission charges and withdrawal issues. We are sharing two different complaints through these screenshots. Take a look.

Introspecting Trade245 Operational Methodology

The South Africa-based forex broker is an unregulated broker as it does not carry a valid license. Thats why the growing scam allegations against it are not a surprise. These brokers scam traders using their tricks and manipulations. Considering the massive complaints and scam risks, the WikiFX team has assigned a score of 2.23 out of 10.

Want to stay updated about the latest forex news and trends? Join the WikiFX Masterminds community today!

Here is how you can be part of it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Thats it, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Fake Trader Faces 20 Years & RM9 Million Fine for RM1.45 Mil Derivatives Scam

A Malaysian man who posed as a ‘licensed’ futures trader has been handed a 20-year prison sentence and a RM9 million fine after admitting to running a fraudulent derivatives investment scam.

WikiFX Broker

Latest News

Join WikiFX’s Agent Growth Event | Turn Your Success into a Global Achievement

Do Kwon Faces 130-Year Prison Sentence After Guilty Plea in $40B Crypto Collapse

Best 5 Low-Spread FX Brokers in India 2025

SEC Settles California Trader with Over $234,000 Spoofing Scheme

Major Pairs in Forex: Top Traded Currency Insights

Forex Trends Explained for Your Successful Trading Experience

What is ECN in Trading? A Simple Guide

Scam Alert: Know the Risky Side of InstaForex in India

Going to Invest in FXCL? Move Back to Avoid Scams & Losses

What Is Forex Trading Fee? A Beginner’s Guide

Currency Calculator