简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Global crude oil market game: the complex chess game behind policy swings and strategic

Zusammenfassung:Trumps Iran policy: Market and negotiation calculations behind his wavering stanceThe USs maximum pressure policy on Iran is in unprecedented chaos. Recently, Trump suddenly stated on social media tha

Trump's Iran policy: Market and negotiation calculations behind his wavering stance

The US's "maximum pressure" policy on Iran is in unprecedented chaos. Recently, Trump suddenly stated on social media that "China can continue to buy Iranian oil now", which is in sharp contrast to his tough stance in May that "all Iranian oil transactions must be stopped immediately". He also bluntly stated at the NATO summit that Iran "needs funds for reconstruction" and "let them sell oil if they want to", completely ignoring the series of policies formulated by his government to strangle Iran's oil exports.

But the opposition is equally strong: Ben Taleb, director of the Iran Project at the US Defense Democracies Foundation, emphasized that after the airstrike is the best time to tighten pressure and cut off Iran's reconstruction resources; Riboua, a senior researcher at the Hudson Institute, warned that relaxing restrictions will be a disguised way of funding Iran's military and proxy networks.

However, Trump's statement is not a policy shift. He made it clear that he would not give up sanctions on Iran, and senior White House officials also confirmed that the relevant restrictions will continue. Riboua believes that this is more likely a "calculated statement" to prevent oil prices from soaring - using market expectations to stabilize prices. Maloney, director of the Brookings Institution's Foreign Policy Program, pointed out the core: Trump's "transactional thinking" on the crisis has led to the current Iran sanctions policy being "extremely chaotic", and this impermanence has become a new risk variable in the market.

OPEC+ production increase: Saudi Arabia leads the battle for market share

In response to the swing of US policy, OPEC+ has launched a wave of production increases. Led by Saudi Arabia, OPEC+ is planning to start the fourth round of large-scale production increases this weekend, with an additional 411,000 barrels per day from August, continuing the pace of production increases from May to July. This decision stems from Saudi Arabia's urgent fight for market share - facing the erosion of competitors such as US shale oil companies, Riyadh is determined to regain the initiative by restoring production capacity.

If this pace continues, two more rounds of production increases will be enough to complete the full resumption of production, and deeper supply restrictions may be lifted by then. However, the actual increase in production has always been less than expected: in May, the eight core member countries only increased production by 154,000 barrels per day, less than 40% of the plan. Iraq and Russia gave up part of their quotas to make up for the previous overproduction, and Kazakhstan continued to overproduce by hundreds of thousands of barrels, which made Saudi Arabia quite dissatisfied.

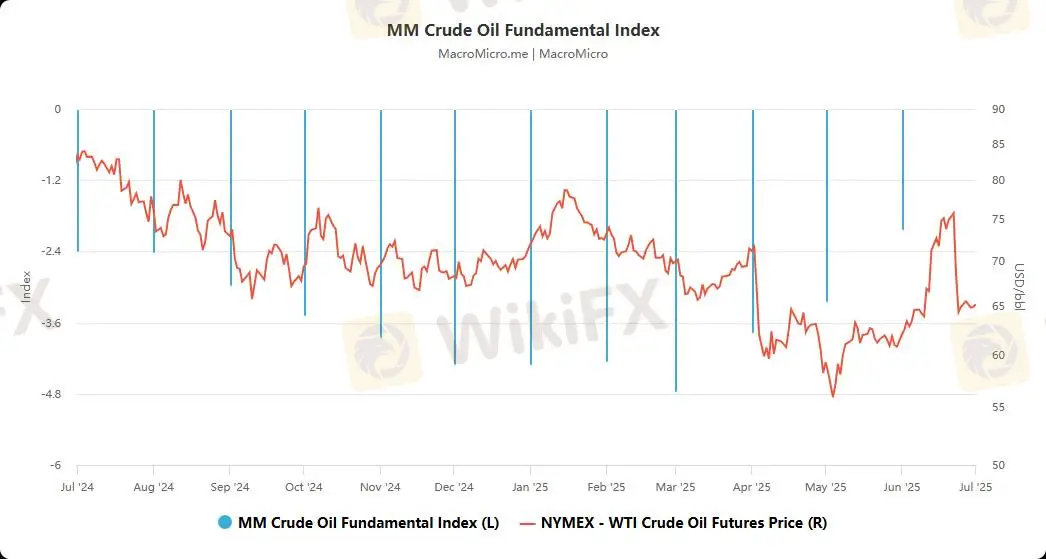

The impact of the increase in production on oil prices was immediate. Affected by this, coupled with the ceasefire agreement between Israel and Iran to ease Middle East export concerns, Brent crude oil futures have fallen to around $68 per barrel, down more than 9% from the beginning of the year. JPMorgan Chase predicts that oil prices may fall to just over $60 later this year and further in 2026. But OPEC+ seems determined. Chilingilian, head of research at Onyx Capital Group, said bluntly: "They have adopted a market share strategy, and the die is cast."

Short-term pressure and long-term layout: the future game of the global crude oil market

OPEC+'s logic of increasing production actually hides long-term strategic considerations. Historically, the organization believed in "reducing production to maintain prices", but behind this shift, there is not only the intention to punish overproducing member countries, but also the calculation of buffering the impact of US sanctions on Iran and giving the Trump administration a "gift of reducing inflation". More importantly, the lack of stamina of non-OPEC oil-producing countries has given OPEC confidence: Goldman Sachs data shows that the average annual discovery of non-shale oil fields in the past five years is only 2.5 billion barrels, less than a quarter of the previous three years; the US Energy Information Administration predicts that shale oil will peak in 2027 and then decline.

Saudi Arabia, Russia and other OPEC+ core countries have continued to rise in fiscal balance due to the growth of infrastructure and welfare spending. In the long term, the energy game has become more complicated: OPEC+'s dynamic production control and the flexible supply strategy of US shale oil are hedging, the US energy policy is swaying, and variables such as the Iran nuclear agreement and Venezuela's resumption of production have emerged frequently, continuing to reshape the global energy landscape. This crude oil game that integrates geopolitical, technological and economic interests is far from over.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Türkei verzeichnet niedrigste Inflation seit dreieinhalb Jahren – doch die Zentralbank warnt

Investor Fabian Westerheide: Kann KI auch VC? Ja, aber.

Schon als Kind mit 10 Euro vom Staat fürs Alter sparen: Was hinter dem Plan der Frühstart-Rente steckt

Wechselkursberechnung